Page 268 - Tata_Chemicals_yearly-reports-2019-20

P. 268

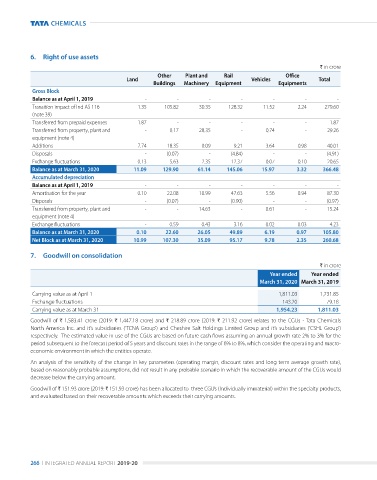

6. Right of use assets

` in crore

Other Plant and Rail Office

Land Vehicles Total

Buildings Machinery Equipment Equipments

Gross Block

Balance as at April 1, 2019 - - - - - - -

transition impact of Ind aS 116 1.35 105.82 30.35 128.32 11.52 2.24 279.60

(note 39)

transferred from prepaid expenses 1.87 - - - - - 1.87

transferred from property, plant and - 0.17 28.35 - 0.74 - 29.26

equipment (note 4)

additions 7.74 18.35 0.09 9.21 3.64 0.98 40.01

disposals - (0.07) - (4.84) - - (4.91)

exchange fluctuations 0.13 5.63 2.35 12.37 0.07 0.10 20.65

Balance as at March 31, 2020 11.09 129.90 61.14 145.06 15.97 3.32 366.48

Accumulated depreciation

Balance as at April 1, 2019 - - - - - - -

amortisation for the year 0.10 22.08 10.99 47.63 5.56 0.94 87.30

disposals - (0.07) - (0.90) - - (0.97)

transferred from property, plant and - - 14.63 - 0.61 - 15.24

equipment (note 4)

exchange fluctuations - 0.59 0.43 3.16 0.02 0.03 4.23

Balance as at March 31, 2020 0.10 22.60 26.05 49.89 6.19 0.97 105.80

Net Block as at March 31, 2020 10.99 107.30 35.09 95.17 9.78 2.35 260.68

7. Goodwill on consolidation

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

Carrying value as at april 1 1,811.03 1,731.85

exchange fluctuations 143.20 79.18

Carrying value as at March 31 1,954.23 1,811.03

goodwill of ` 1,583.41 crore (2019: ` 1,447.18 crore) and ` 218.89 crore (2019: ` 211.92 crore) relates to the Cgus - tata Chemicals

north america Inc. and it’s subsidiaries (‘tCna group’) and Cheshire Salt Holdings limited group and it’s subsidiaries (‘CSHl group’)

respectively. the estimated value in use of the Cgus are based on future cash flows assuming an annual growth rate 2% to 3% for the

period subsequent to the forecast period of 5 years and discount rates in the range of 6% to 8%, which consider the operating and macro-

economic environment in which the entities operate.

an analysis of the sensitivity of the change in key parameters (operating margin, discount rates and long term average growth rate),

based on reasonably probable assumptions, did not result in any probable scenario in which the recoverable amount of the Cgus would

decrease below the carrying amount.

goodwill of ` 151.93 crore (2019: ` 151.93 crore) has been allocated to three Cgus (Individually immaterial) within the specialty products,

and evaluated based on their recoverable amounts which exceeds their carrying amounts.

266 I Integrated annual report 2019-20