Page 269 - Tata_Chemicals_yearly-reports-2019-20

P. 269

Integrated report Statutory reportS Financial StatementS

Consolidated

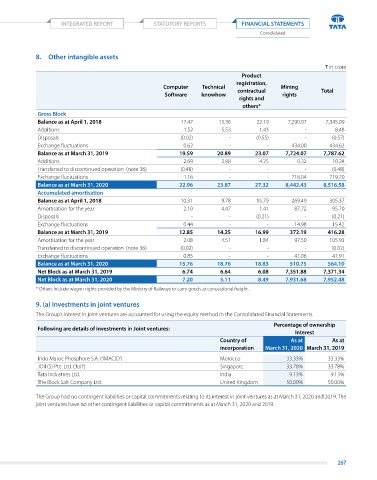

8. Other intangible assets

` in crore

Product

registration,

Computer Technical contractual Mining Total

Software knowhow rights

rights and

others*

Gross Block

Balance as at April 1, 2018 17.47 15.36 22.19 7,290.07 7,345.09

additions 1.52 5.53 1.43 - 8.48

disposals (0.02) - (0.55) - (0.57)

exchange fluctuations 0.62 - - 434.00 434.62

Balance as at March 31, 2019 19.59 20.89 23.07 7,724.07 7,787.62

additions 2.69 2.98 4.25 0.32 10.24

transferred to discontinued operation (note 36) (0.48) - - - (0.48)

exchange fluctuations 1.16 - - 718.04 719.20

Balance as at March 31, 2020 22.96 23.87 27.32 8,442.43 8,516.58

Accumulated amortisation

Balance as at April 1, 2018 10.31 9.78 15.79 269.49 305.37

amortisation for the year 2.10 4.47 1.41 87.72 95.70

disposals - - (0.21) - (0.21)

exchange fluctuations 0.44 - - 14.98 15.42

Balance as at March 31, 2019 12.85 14.25 16.99 372.19 416.28

amortisation for the year 2.08 4.51 1.84 97.50 105.93

transferred to discontinued operation (note 36) (0.02) - - - (0.02)

exchange fluctuations 0.85 - - 41.06 41.91

Balance as at March 31, 2020 15.76 18.76 18.83 510.75 564.10

Net Block as at March 31, 2019 6.74 6.64 6.08 7,351.88 7,371.34

Net Block as at March 31, 2020 7.20 5.11 8.49 7,931.68 7,952.48

* others include wagon rights provided by the Ministry of railways to carry goods at concessional freight.

9. (a) Investments in joint ventures

the group’s interest in joint ventures are accounted for using the equity method in the Consolidated Financial Statements.

Percentage of ownership

Following are details of investments in Joint ventures:

Interest

Country of As at As at

incorporation March 31, 2020 March 31, 2019

Indo Maroc phosphore S.a. ('IMaCId') Morocco 33.33% 33.33%

Joil (S) pte. ltd. ('Joil') Singapore 33.78% 33.78%

tata Industries ltd. India 9.13% 9.13%

the Block Salt Company ltd. united Kingdom 50.00% 50.00%

the group had no contingent liabilities or capital commitments relating to its interest in joint ventures as at March 31, 2020 and 2019. the

joint ventures have no other contingent liabilities or capital commitments as at March 31, 2020 and 2019.

267