Page 272 - Tata_Chemicals_yearly-reports-2019-20

P. 272

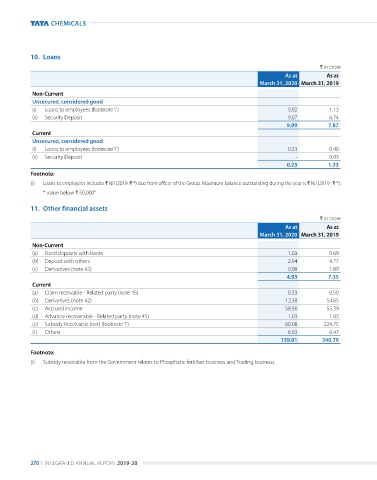

10. Loans

` in crore

As at As at

March 31, 2020 March 31, 2019

Non-Current

Unsecured, considered good

(i) loans to employees (footnote 'i') 0.92 1.13

(ii) Security deposit 9.07 6.74

9.99 7.87

Current

Unsecured, considered good

(i) loans to employees (footnote 'i') 0.23 0.40

(ii) Security deposit - 0.93

0.23 1.33

Footnote:

(i) loans to employees includes ` nil (2019: ` *) due from officer of the group. Maximum balance outstanding during the year is ` nil (2019 : ` *).

* value below ` 50,000”

11. Other financial assets

` in crore

As at As at

March 31, 2020 March 31, 2019

Non-Current

(a) Fixed deposits with banks 1.03 0.69

(b) deposit with others 2.94 4.77

(c) derivatives (note 42) 0.96 1.89

4.93 7.35

Current

(a) Claim receivable - related party (note 45) 0.33 0.50

(b) derivatives (note 42) 12.38 54.65

(c) accrued income 58.56 53.39

(d) advance recoverable - related party (note 45) 1.03 1.03

(e) Subsidy receivable (net) (footnote 'i') 60.08 224.75

(f) others 6.63 6.47

139.01 340.79

Footnote:

(i) Subsidy receivable from the government relates to phosphatic fertiliser business and trading business.

270 I Integrated annual report 2019-20