Page 250 - Tata_Chemicals_yearly-reports-2019-20

P. 250

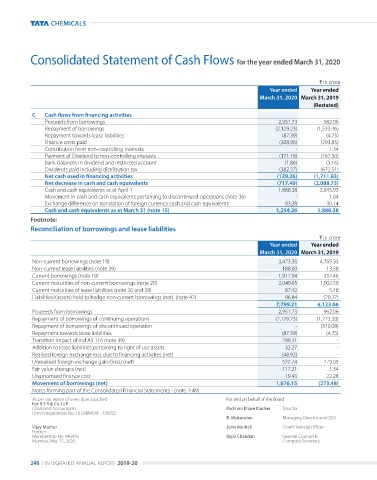

Consolidated Statement of Cash Flows for the year ended March 31, 2020

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

C Cash flows from financing activities

proceeds from borrowings 2,951.73 962.06

repayment of borrowings (2,129.23) (1,533.46)

repayment towards lease liabilities (87.39) (4.75)

Finance costs paid (308.96) (293.85)

Contribution from non-controlling interests - 1.34

payment of dividend to non-controlling interests (171.18) (167.50)

Bank balances in dividend and restricted account (1.86) (3.16)

dividends paid including distribution tax (382.37) (672.51)

Net cash used in financing activities (129.26) (1,711.83)

Net decrease in cash and cash equivalents (717.40) (2,088.73)

Cash and cash equivalents as at april 1 1,888.38 3,945.93

Movement in cash and cash equivalents pertaining to discontinued operations (note 36) - 1.04

exchange difference on translation of foreign currency cash and cash equivalents 83.28 30.14

Cash and cash equivalents as at March 31 (note 15) 1,254.26 1,888.38

Footnote:

Reconciliation of borrowings and lease liabilities

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

non-current borrowings (note 19) 3,473.36 4,769.33

non-current lease liabilities (note 39) 188.00 13.58

Current borrowings (note 19) 1,912.94 352.46

Current maturities of non-current borrowings (note 20) 2,040.65 1,002.58

Current maturities of lease liabilities (note 20 and 39) 87.42 5.48

liabilities/(assets) held to hedge non-current borrowings (net) (note 42) 96.84 (20.37)

7,799.21 6,123.06

proceeds from borrowings 2,951.73 962.06

repayment of borrowings of continuing operations (2,129.23) (1,223.38)

repayment of borrowings of discontinued operation - (310.08)

repayment towards lease liabilities (87.39) (4.75)

transition impact of Ind aS 116 (note 39) 298.31 -

addition to lease liabilities pertaining to right of use assets 32.27 -

realised foreign exchange loss due to financing activities (net) (48.92) -

unrealised foreign exchange gain/(loss) (net) 522.74 279.05

Fair value changes (net) 117.21 1.34

unamortised finance cost 19.43 22.28

Movement of borrowings (net) 1,676.15 (273.48)

notes forming part of the Consolidated Financial Statements - (note 1-49)

as per our report of even date attached For and on behalf of the Board

For B S R & Co. LLP

Chartered accountants Padmini Khare Kaicker director

Firm's registration no: 101248W/W - 100022

R. Mukundan Managing director and Ceo

Vijay Mathur John Mulhall Chief Financial officer

partner

Membership no. 046476 Rajiv Chandan general Counsel &

Mumbai, May 15, 2020 Company Secretary

248 I Integrated annual report 2019-20