Page 247 - Tata_Chemicals_yearly-reports-2019-20

P. 247

Integrated report Statutory reportS Financial StatementS

Consolidated

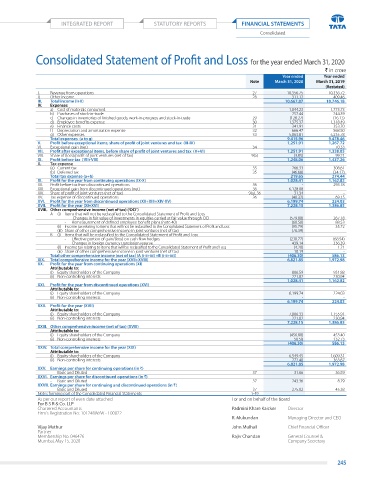

Consolidated Statement of Profit and Loss for the year ended March 31, 2020

` in crore

Year ended Year ended

Note March 31, 2020 March 31, 2019

(Restated)

I. revenue from operations 27 10,356.75 10,336.72

II. other income 28 311.12 409.46

III. Total income (I+II) 10,667.87 10,746.18

IV. Expenses

a) Cost of materials consumed 1,844.23 1,773.73

b) purchases of stock-in-trade 252.44 244.39

c) Changes in inventories of finished goods, work-in-progress and stock-in-trade 29 (128.27) (16.13)

d) employee benefits expense 30 1,375.37 1,318.49

e) Finance costs 31 341.91 353.70

f) depreciation and amortisation expense 32 666.47 568.50

g) other expenses 33 5,063.81 5,235.78

Total expenses (a to g) 9,415.96 9,478.46

V. Profit before exceptional items, share of profit of joint ventures and tax (III-IV) 1,251.91 1,267.72

VI. exceptional gain (net) 34 - 70.33

VII. Profit after exceptional items, before share of profit of joint ventures and tax (V+VI) 1,251.91 1,338.05

VIII. Share of (loss)/profit of joint ventures (net of tax) 9(a) (3.85) 99.21

IX. Profit before tax (VII+VIII) 1,248.06 1,437.26

X. Tax expense

(a) Current tax 35 266.33 308.61

(b) deferred tax 35 (46.68) (34.17)

Total tax expense (a+b) 219.65 274.44

XI. Profit for the year from continuing operations (IX-X) 1,028.41 1,162.82

XII. profit before tax from discontinued operations 36 - 293.18

XIII. exceptional gain from discontinued operations (net) 36 6,128.08 -

XIV. Share of profit of joint ventures (net of tax) 9(a), 36 31.34 -

XV. tax expense of discontinued operations 36 (40.32) 69.15

XVI. Profit for the year from discontinued operations (XII+XIII+XIV-XV) 6,199.74 224.03

XVII. Profit for the year (XI+XVI) 7,228.15 1,386.85

XVIII. Other comprehensive income (net of tax) (‘OCI’)

a (i) Items that will not be reclassified to the Consolidated Statement of profit and loss

- Changes in fair value of investments in equities carried at fair value through oCI (579.88) 267.18

- remeasurement of defined employee benefit plans (note 40) (68.58) 88.53

(ii) Income tax relating to items that will not be reclassified to the Consolidated Statement of profit and loss (95.79) 35.72

(iii) Share of other comprehensive income in joint ventures (net of tax) (76.39) -

B (i) Items that will be reclassified to the Consolidated Statement of profit and loss

- effective portion of gain/(loss) on cash flow hedges (230.77) (68.54)

- Changes in foreign currency translation reserve 439.14 336.39

(ii) Income tax relating to items that will be reclassified to the Consolidated Statement of profit and loss (4.20) 1.71

(iii) Share of other comprehensive income in joint ventures (net of tax) 10.19 -

Total other comprehensive income (net of tax) (A (i-ii+iii) +B (i-ii+iii)) (406.30) 586.13

XIX. Total comprehensive income for the year (XVII+XVIII) 6,821.85 1,972.98

XX. Profit for the year from continuing operations (XI)

Attributable to:

(i) equity shareholders of the Company 806.59 931.88

(ii) non-controlling interests 221.82 230.94

1,028.41 1,162.82

XXI. Profit for the year from discontinued operations (XVI)

Attributable to:

(i) equity shareholders of the Company 6,199.74 224.03

(ii) non-controlling interests - -

6,199.74 224.03

XXII. Profit for the year (XVII)

Attributable to:

(i) equity shareholders of the Company 7,006.33 1,155.91

(ii) non-controlling interests 221.82 230.94

7,228.15 1,386.85

XXIII. Other comprehensive income (net of tax) (XVIII)

Attributable to:

(i) equity shareholders of the Company (456.88) 453.40

(ii) non-controlling interests 50.58 132.73

(406.30) 586.13

XXIV. Total comprehensive income for the year (XIX)

Attributable to:

(i) equity shareholders of the Company 6,549.45 1,609.31

(ii) non-controlling interests 272.40 363.67

6,821.85 1,972.98

XXV. Earnings per share for continuing operations (in `)

- Basic and diluted 37 31.66 36.59

XXVI. Earnings per share for discontinued operations (in `)

- Basic and diluted 37 243.36 8.79

XXVII. Earnings per share for continuing and discontinued operations (in `)

- Basic and diluted 37 275.02 45.38

notes forming part of the Consolidated Financial Statements 1-49

as per our report of even date attached For and on behalf of the Board

For B S R & Co. LLP

Chartered accountants Padmini Khare Kaicker director

Firm's registration no: 101248W/W - 100022

R. Mukundan Managing director and Ceo

Vijay Mathur John Mulhall Chief Financial officer

partner

Membership no. 046476 Rajiv Chandan general Counsel &

Mumbai, May 15, 2020 Company Secretary

245