Page 215 - Tata_Chemicals_yearly-reports-2019-20

P. 215

Integrated report Statutory reportS Financial StatementS

Standalone

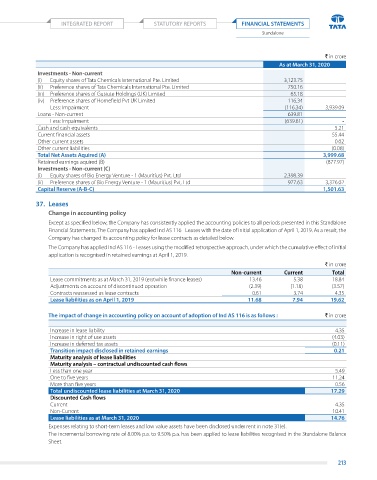

` in crore

As at March 31, 2020

Investments - Non-current

(i) Equity shares of Tata Chemicals International Pte. Limited 3,123.75

(ii) Preference shares of Tata Chemicals International Pte. Limited 750.16

(iii) Preference shares of Gusiute Holdings (uK) Limited 65.18

(iv) Preference shares of Homefield Pvt uK Limited 116.34

Less: Impairment (116.34) 3,939.09

Loans - Non-current 639.81

Less: Impairment (639.81) -

Cash and cash equivalents 5.21

Current financial assets 55.44

Other current assets 0.02

Other current liabilities (0.08)

Total Net Assets Aquired (A) 3,999.68

Retained earnings aquired (B) (877.97)

Investments - Non-current (C)

(i) Equity shares of Bio Energy Venture - 1 (Mauritius) Pvt. Ltd 2,398.39

(ii) Preference shares of Bio Energy Venture - 1 (Mauritius) Pvt. Ltd 977.63 3,376.02

Capital Reserve (A-B-C) 1,501.63

37. Leases

Change in accounting policy

Except as specified below, the Company has consistently applied the accounting policies to all periods presented in this Standalone

Financial Statements. The Company has applied Ind AS 116 - Leases with the date of initial application of April 1, 2019. As a result, the

Company has changed its accounting policy for lease contracts as detailed below.

The Company has applied Ind AS 116 - Leases using the modified retrospective approach, under which the cumulative effect of initial

application is recognised in retained earnings at April 1, 2019.

` in crore

Non-current Current Total

Lease commitments as at March 31, 2019 (erstwhile finance leases) 13.46 5.38 18.84

Adjustments on account of discontinued operation (2.39) (1.18) (3.57)

Contracts reassessed as lease contracts 0.61 3.74 4.35

Lease liabilities as on April 1, 2019 11.68 7.94 19.62

The impact of change in accounting policy on account of adoption of Ind AS 116 is as follows : ` in crore

Increase in lease liability 4.35

Increase in right of use assets (4.03)

Increase in deferred tax assets (0.11)

Transition impact disclosed in retained earnings 0.21

Maturity analysis of lease liabilities

Maturity analysis – contractual undiscounted cash flows

Less than one year 5.49

One to five years 11.24

More than five years 0.56

Total undiscounted lease liabilities at March 31, 2020 17.29

Discounted Cash flows

Current 4.35

Non-Current 10.41

Lease liabilities as at March 31, 2020 14.76

Expenses relating to short-term leases and low value assets have been disclosed under rent in note 31(e).

The incremental borrowing rate of 8.00% p.a. to 9.50% p.a. has been applied to lease liabilities recognised in the Standalone Balance

Sheet.

213