Page 218 - Tata_Chemicals_yearly-reports-2019-20

P. 218

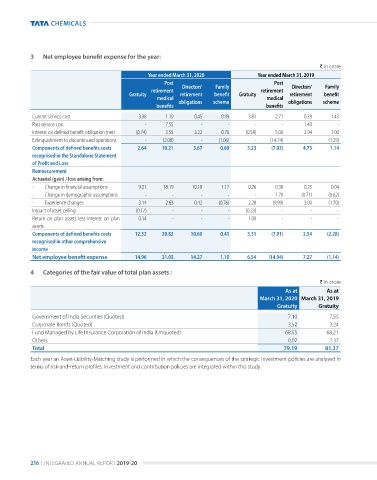

3 Net employee benefit expense for the year:

` in crore

Year ended March 31, 2020 Year ended March 31, 2019

Post Post

retirement Directors' Family retirement Directors' Family

Gratuity retirement benefit Gratuity retirement benefit

medical obligations scheme medical obligations scheme

benefits benefits

Current service cost 3.38 1.19 0.45 0.99 3.81 2.71 0.39 1.43

Past service cost - 7.55 - - - - 1.40 -

Interest on defined benefit obligation (net) (0.74) 3.55 3.22 0.76 (0.58) 5.00 2.94 1.00

Extinguishment to discontinued operations - (2.08) - (1.06) - (14.74) - (1.29)

Components of defined benefits costs 2.64 10.21 3.67 0.69 3.23 (7.03) 4.73 1.14

recognised in the Standalone Statement

of Profit and Loss

Remeasurement

Actuarial (gain) / loss arising from:

- Change in financial assumptions 9.21 18.19 10.18 1.17 0.26 0.38 0.25 0.04

- Change in demographic assumptions - - - - - 1.70 (0.71) (0.62)

- Experience changes 3.14 2.63 0.42 (0.76) 2.28 (9.99) 3.00 (1.70)

Impact of asset ceiling (0.17) - - - (0.23) - - -

Return on plan assets less interest on plan 0.14 - - - 1.00 - - -

assets

Components of defined benefits costs 12.32 20.82 10.60 0.41 3.31 (7.91) 2.54 (2.28)

recognised in other comprehensive

income

Net employee benefit expense 14.96 31.03 14.27 1.10 6.54 (14.94) 7.27 (1.14)

4 Categories of the fair value of total plan assets :

` in crore

As at As at

March 31, 2020 March 31, 2019

Gratuity Gratuity

Government of India Securities (Quoted) 7.10 7.55

Corporate Bonds (Quoted) 3.52 3.24

Fund Managed by Life Insurance Corporation of India (unquoted) 68.55 68.21

Others 0.02 2.37

Total 79.19 81.37

Each year an Asset-Liability-Matching study is performed in which the consequences of the strategic investment policies are analysed in

terms of risk-and-return profiles. Investment and contribution policies are integrated within this study.

216 I INTEGRATED ANNuAL REPORT 2019-20