Page 212 - Tata_Chemicals_yearly-reports-2019-20

P. 212

34. Discontinued operations

(I) Disposal of consumer products business

The National Company Law Tribunal (“NCLT”), Mumbai and NCLT Kolkata, on January 10, 2020 and January 8, 2020 respectively,

sanctioned the Scheme of Arrangement amongst Tata Consumer Products Limited (formerly Tata Global Beverages Limited) ("TCPL")

and the Company and their respective shareholders and creditors (“the Scheme”) for the demerger of the Consumer Products

Business unit ("CPB") of the Company to TCPL. The Scheme became effective on February 7, 2020 upon filing of the certified copies

of the NCLT Orders sanctioning the Scheme with the respective jurisdictional Registrar of Companies. Pursuant to the Scheme

becoming effective, the CPB is demerged from the Company and transferred to and vested in TCPL with effect from April 1, 2019 i.e.

the Appointed Date.

As per the clarification issued by Ministry of Corporate Affairs vide Circular no. 09/2019 dated August 21, 2019 (MCA Circular), the

Company has recognised the effect of the demerger on April 1, 2019 and debited the fair value as at April 1, 2019 of Demerged

undertaking i.e. fair value of net assets of CPB to be distributed to the shareholders of the Company, amounting to ` 6,307.97 crore to

the retained earnings in the Statement of Changes in Equity as dividend distribution. The difference in the fair value and the carrying

amount of net assets of CPB as at April 1, 2019 is recognised as gain on demerger of CPB in the Statement of Profit and Loss as an

exceptional item, amounting to ` 6,220.15 crore (net of transaction cost) during the year ended March 31, 2020. Accordingly, the

operations of CPB have been reclassified as discontinued operations for the year ended March 31, 2019 and comparative information

in the Statement of Profit and loss account has been restated in accordance with Ind AS 105.

(II) Disposal of Phosphatic fertiliser business and Trading business of bulk and non-bulk fertilisers

On June 1, 2018, the Company consummated the sale and transfer of its Phosphatic fertiliser business located at Haldia and the

Trading business comprising bulk and non-bulk fertilisers to IRC Agrochemicals Private Limited ("IRC") as per Business Transfer

Agreement dated November 6, 2017.

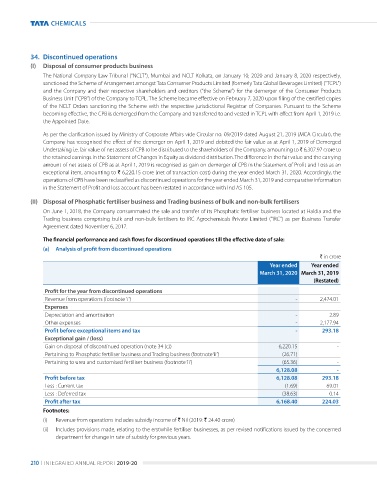

The financial performance and cash flows for discontinued operations till the effective date of sale:

(a) Analysis of profit from discontinued operations

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

Profit for the year from discontinued operations

Revenue from operations (footnote 'i') - 2,474.01

Expenses

Depreciation and amortisation - 2.89

Other expenses - 2,177.94

Profit before exceptional items and tax - 293.18

Exceptional gain / (loss)

Gain on disposal of discontinued operation (note 34 (c)) 6,220.15 -

Pertaining to Phosphatic fertiliser business and Trading business (footnote ‘ii’) (26.71) -

Pertaining to urea and customised fertiliser business (footnote ‘ii’) (65.36) -

6,128.08 -

Profit before tax 6,128.08 293.18

Less : Current tax (1.69) 69.01

Less : Deferred tax (38.63) 0.14

Profit after tax 6,168.40 224.03

Footnotes:

(i) Revenue from operations includes subsidy income of ` Nil (2019: ` 24.40 crore)

(ii) Includes provisions made, relating to the erstwhile fertiliser businesses, as per revised notifications issued by the concerned

department for change in rate of subsidy for previous years.

210 I INTEGRATED ANNuAL REPORT 2019-20