Page 211 - Tata_Chemicals_yearly-reports-2019-20

P. 211

Integrated report Statutory reportS Financial StatementS

Standalone

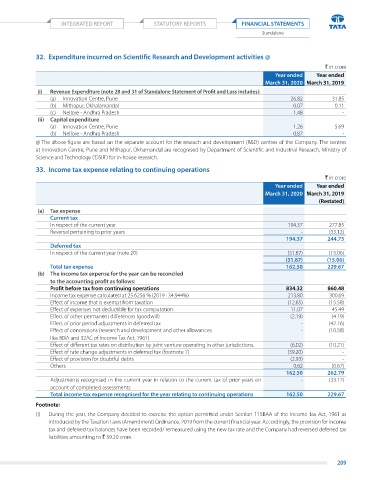

32. Expenditure incurred on Scientific Research and Development activities @

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(i) Revenue Expenditure (note 28 and 31 of Standalone Statement of Profit and Loss includes):

(a) Innovation Centre, Pune 26.82 31.85

(b) Mithapur, Okhalamandal 0.07 0.11

(c) Nellore - Andhra Pradesh 1.48 -

(ii) Capital expenditure

(a) Innovation Centre, Pune 1.26 5.69

(b) Nellore - Andhra Pradesh 0.87 -

@ The above figure are based on the separate account for the reseach and development (R&D) centres of the Company. The centres

at Innovation Centre, Pune and Mithapur, Okhamandal are recognised by Department of Scientific and Industrial Research, Ministry of

Science and Technology ('DSIR') for in-house research.

33. Income tax expense relating to continuing operations

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

(a) Tax expense

Current tax

In respect of the current year 194.37 277.85

Reversal pertaining to prior years - (33.12)

194.37 244.73

Deferred tax

In respect of the current year (note 20) (31.87) (15.06)

(31.87) (15.06)

Total tax expense 162.50 229.67

(b) The income tax expense for the year can be reconciled

to the accounting profit as follows:

Profit before tax from continuing operations 834.32 860.48

Income tax expense calculated at 25.6256 % (2019 : 34.944%) 213.80 300.69

Effect of income that is exempt from taxation (12.65) (15.58)

Effect of expenses not deductible for tax computation 11.07 45.49

Effect of other permanent differences (goodwill) (2.19) (4.19)

Effect of prior period adjustments in deferred tax - (42.16)

Effect of concessions (research and development and other allowances - (10.58)

like 80IA and 32AC of Income Tax Act, 1961)

Effect of different tax rates on distribution by joint venture operating in other jurisdictions. (6.02) (10.21)

Effect of rate change adjustments in deferred tax (footnote 'i') (39.20) -

Effect of provision for doubtful debts (2.93) -

Others 0.62 (0.67)

162.50 262.79

Adjustments recognised in the current year in relation to the current tax of prior years on - (33.12)

account of completed assessments

Total income tax expense recognised for the year relating to continuing operations 162.50 229.67

Footnote:

(i) During the year, the Company decided to exercise the option permitted under Section 115BAA of the Income Tax Act, 1961 as

introduced by the Taxation Laws (Amendment) Ordinance, 2019 from the current financial year. Accordingly, the provision for income

tax and deferred tax balances have been recorded/ remeasured using the new tax rate and the Company had reversed deferred tax

liabilities amounting to ` 39.20 crore.

209