Page 114 - Tata_Chemicals_yearly-reports-2019-20

P. 114

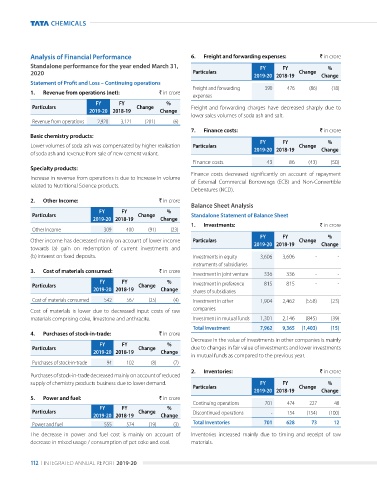

Analysis of Financial Performance 6. Freight and forwarding expenses: ` in crore

Standalone performance for the year ended March 31, FY FY %

2020 Particulars 2019-20 2018-19 Change Change

Statement of Profit and Loss – Continuing operations

Freight and forwarding 390 476 (86) (18)

1. Revenue from operations (net): ` in crore

expenses

FY FY %

Particulars Change Freight and forwarding charges have decreased sharply due to

2019-20 2018-19 Change

lower sales volumes of soda ash and salt.

revenue from operations 2,920 3,121 (201) (6)

7. Finance costs: ` in crore

Basic chemistry products:

FY FY %

lower volumes of soda ash was compensated by higher realisation Particulars 2019-20 2018-19 Change Change

of soda ash and revenue from sale of new cement variant.

Finance costs 43 86 (43) (50)

Specialty products:

Finance costs decreased significantly on account of repayment

Increase in revenue from operations is due to increase in volume of external Commercial Borrowings (eCB) and non-Convertible

related to nutritional Science products.

debentures (nCd).

2. Other Income: ` in crore

Balance Sheet Analysis

FY FY %

Particulars Change Standalone Statement of Balance Sheet

2019-20 2018-19 Change

1. Investments: ` in crore

other Income 309 400 (91) (23)

FY FY %

other income has decreased mainly on account of lower income Particulars 2019-20 2018-19 Change Change

towards (a) gain on redemption of current investments and

(b) interest on fixed deposits. Investments in equity 3,606 3,606 - -

instruments of subsidiaries

3. Cost of materials consumed: ` in crore

Investment in joint venture 336 336 - -

FY FY %

Particulars Change Investment in preference 815 815 - -

2019-20 2018-19 Change shares of subsidiaries

Cost of materials consumed 542 567 (25) (4) Investment in other 1,904 2,462 (558) (23)

Cost of materials is lower due to decreased input costs of raw companies

materials comprising coke, limestone and anthracite. Investment in mutual funds 1,301 2,146 (845) (39)

Total Investment 7,962 9,365 (1,403) (15)

4. Purchases of stock-in-trade: ` in crore

decrease in the value of investments in other companies is mainly

FY FY %

Particulars Change due to changes in fair value of investments and lower investments

2019-20 2018-19 Change

in mutual funds as compared to the previous year.

purchases of stock-in-trade 94 102 (8) (7)

2. Inventories: ` in crore

purchases of stock-in-trade decreased mainly on account of reduced

supply of chemistry products business due to lower demand. FY FY %

Particulars Change

2019-20 2018-19 Change

5. Power and fuel: ` in crore

Continuing operations 701 474 227 48

FY FY %

Particulars Change discontinued operations - 154 (154) (100)

2019-20 2018-19 Change

power and fuel 555 574 (19) (3) Total Inventories 701 628 73 12

the decrease in power and fuel cost is mainly on account of Inventories increased mainly due to timing and receipt of raw

decrease in mixed usage / consumption of pet coke and coal. materials.

112 I Integrated annual report 2019-20