Page 60 - Tata_Chemicals_yearly-reports-2017-18

P. 60

Board’s Report

TO THE MEMBERS OF TATA CHEMICALS LIMITED

The Directors hereby present their seventy ninth Annual Report together with the audited financial statements for the Financial Year (FY) ended

31 March, 2018.

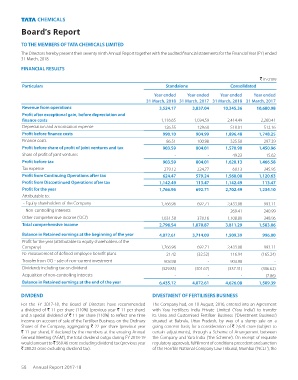

FINANCIAL RESULTS

` in crore

Particulars Standalone Consolidated

Year ended Year ended Year ended Year ended

31 March, 2018 31 March, 2017 31 March, 2018 31 March, 2017

Revenue from operations 3,524.17 3,837.04 10,345.36 10,680.98

Profit after exceptional gain, before depreciation and

finance costs 1,116.65 1,034.59 2,414.49 2,260.41

Depreciation and amortisation expense 126.55 129.60 518.01 512.16

Profit before finance costs 990.10 904.99 1,896.48 1,748.25

Finance costs 86.51 100.98 325.58 297.29

Profit before share of profit of joint ventures and tax 903.59 804.01 1,570.90 1,450.96

Share of profit of joint ventures - - 49.23 15.62

Profit before tax 903.59 804.01 1,620.13 1,466.58

Tax expense 279.12 224.77 60.13 345.95

Profit from Continuing Operations after tax 624.47 579.24 1,560.00 1,120.63

Profit from Discontinued Operations after tax 1,142.49 113.47 1,142.49 113.47

Profit for the year 1,766.96 692.71 2,702.49 1,234.10

Attributable to:

- Equity shareholders of the Company 1,766.96 692.71 2,433.08 993.11

- Non-controlling interests - - 269.41 240.99

Other comprehensive income (‘OCI’) 1,031.58 378.16 1,108.80 348.96

Total comprehensive income 2,798.54 1,070.87 3,811.29 1,583.06

Balance in Retained earnings at the beginning of the year 4,072.61 3,714.09 1,509.39 996.00

Profit for the year (attributable to equity shareholders of the

Company) 1,766.96 692.71 2,433.08 993.11

Re-measurement of defined employee benefit plans 21.42 (32.52) 116.94 (165.24)

Transfer from OCI - sale of non-current investment 903.98 - 903.98 -

Dividends including tax on dividend (329.85) (301.67) (337.31) (306.62)

Acquisition of non-controlling interests - - - (7.86)

Balance in Retained earnings at the end of the year 6,435.12 4,072.61 4,626.08 1,509.39

DIVIDEND DIVESTMENT OF FERTILISERS BUSINESS

For the FY 2017-18, the Board of Directors have recommended The Company had, on 10 August, 2016, entered into an Agreement

a dividend of ` 11 per share (110%) (previous year ` 11 per share) with Yara Fertilisers India Private Limited (‘Yara India’) to transfer

and a special dividend of ` 11 per share (110%) to reflect one time its Urea and Customised Fertiliser Business (‘Divestment Business’)

income on account of sale of the Fertiliser Business, on the Ordinary situated at Babrala, Uttar Pradesh, by way of a slump sale on a

Shares of the Company, aggregating ` 22 per share (previous year going concern basis, for a consideration of ` 2,670 crore (subject to

` 11 per share). If declared by the members at the ensuing Annual certain adjustments), through a Scheme of Arrangement between

General Meeting (‘AGM’), the total dividend outgo during FY 2018-19 the Company and Yara India (‘the Scheme’). On receipt of requisite

would amount to ` 560.46 crore excluding dividend tax (previous year regulatory approvals, fulfillment of conditions precedent and sanction

` 280.23 crore excluding dividend tax). of the Hon’ble National Company Law Tribunal, Mumbai (‘NCLT’), the

58 Annual Report 2017-18