Page 264 - Tata Chemical Annual Report_2022-2023

P. 264

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

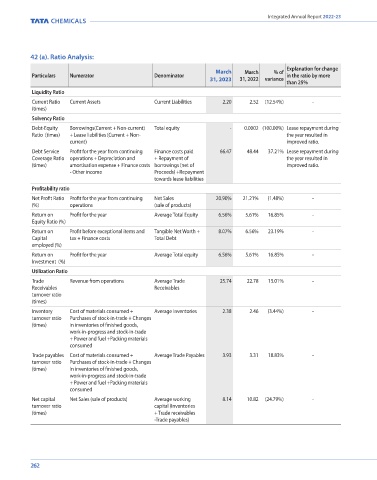

42 (a). Ratio Analysis: 42 (b). Note on Ultimate Beneficiaries

Explanation for change No funds have been advanced or loaned or invested (either from borrowed funds or share premium or any other sources or

March March % of

Particulars Numerator Denominator in the ratio by more kind of funds) by the Company to or in any other person(s) or entity(ies), including foreign entities (“Intermediaries”), with the

31, 2023 31, 2022 variance

than 25% understanding, whether recorded in writing or otherwise, that the Intermediary shall directly or indirectly lend or invest in other

Liquidity Ratio persons or entities identified in any manner whatsoever by or on behalf of the Company (“Ultimate Beneficiaries”) or provide

any guarantee, security or the like on behalf of the Ultimate Beneficiaries.

Current Ratio Current Assets Current Liabilities 2.20 2.52 (12.54%) -

(times)

No funds have been received by the Company from any person(s) or entity(ies), including foreign entities (“Funding Parties”),

Solvency Ratio with the understanding, whether recorded in writing or otherwise, that the Company shall directly or indirectly, lend or invest

Debt-Equity Borrowings(Current + Non-current) Total equity - 0.0002 (100.00%) Lease repayment during in other persons or entities identified in any manner whatsoever by or on behalf of the Funding Parties (“Ultimate Beneficiaries”)

Ratio (times) + Lease liabilities (Current + Non- the year resulted in or provide any guarantee, security or the like on behalf of the Ultimate Beneficiaries.

current) improved ratio.

Debt Service Profit for the year from continuing Finance costs paid 66.47 48.44 37.21% Lease repayment during 42 (c). Borrowing based on security of current assets

Coverage Ratio operations + Depreciation and + Repayment of the year resulted in The Company has obtained borrowings from bank on basis of security of current assets wherein the quarterly returns/ statements

(times) amortisation expense + Finance costs borrowings (net of improved ratio. of current assets as filed with bank are in agreement with the books.

- Other income Proceeds) +Repayment

towards lease liabilities 42 (d). Transactions with Struck off companies

Profitability ratio

Nature of Balance Relationship with Balance Relationship

Net Profit Ratio Profit for the year from continuing Net Sales 20.90% 21.21% (1.48%) - transactions outstanding the struck off outstanding with the struck

(%) operations (sale of products) Name of the struck off Company with struck off as at March 31, Company if any, as at March 31, off Company

Return on Profit for the year Average Total Equity 6.56% 5.61% 16.85% - Company 2023 to be disclosed 2022 if any, to be

disclosed

Equity Ratio (%)

NXTGEN Future SCM Private Limited

Return on Profit before exceptional items and Tangible Net Worth + 8.07% 6.56% 23.19% - (CIN:U63000GJ2014PTC079161) Payable * No * No

Capital tax + Finance costs Total Debt

employed (%) * value below Rs. 0.50 crore

Return on Profit for the year Average Total equity 6.56% 5.61% 16.85% - 42 (e). Disclosures pursuant to regulation 34 (3) of securities and exchange board of india (listing

Investment (%) obligations and disclosure requirements) regulations, 2015 and section 186 of the companies

Utilization Ratio act, 2013.

Trade Revenue from operations Average Trade 25.74 22.78 13.01% - i) Investment in perpetual instrument (note 8(b))

Receivables Receivables

turnover ratio Tata International Limited has utilised the funds for its debt refinancing and general corporate purposes. Term of this

(times) investment is perpetual in nature and carries initial interest rate of 9.20% p.a. Maximum balance outstanding during

Inventory Cost of materials consumed + Average Inventories 2.38 2.46 (3.44%) - the year is ` 150 crore (2022: Nil)

turnover ratio Purchases of stock-in-trade + Changes ii) Investment in Non convertible Debentures - quoted (note 8(c))

(times) in inventories of finished goods,

work-in-progress and stock-in-trade Surplus funds have been invested with various corporates (un-related parties). It is repayable within 1 year and carries

+ Power and fuel +Packing materials interest rate in the range of 7.00% to 7.25% p.a. Maximum balance outstanding during the year is ` 39 crore (2022:

consumed Nil)

Trade payables Cost of materials consumed + Average Trade Payables 3.93 3.31 18.83% - iii) Inter-corporate Deposits (note 9)

turnover ratio Purchases of stock-in-trade + Changes

(times) in inventories of finished goods, Surplus funds have been invested with various corporates (un-related parties). It is repayable within 1 year and carries

work-in-progress and stock-in-trade interest rate in the range of 6.65% to 8.15% p.a. Maximum balance outstanding during the year is ` 350 crore (2022:

+ Power and fuel +Packing materials Nil)

consumed

iv) Particulars of investments in Subsidiaries, Joint ventures and associates and other investments are given in note 8.

Net capital Net Sales (sale of products) Average working 8.14 10.82 (24.79%) -

turnover ratio capital (Inventories v) The Company has not provided any guarantee or security covered under Section 186 and accordingly, the disclosure

(times) + Trade receivables requirements to that extent does not apply to the Company.

-Trade payables)

vi) In line with Circular No 04/2015 issued by Ministry of Corporate Affairs dated 10/03/2015, loans given to employees

as per the Company’s policy are not considered for the purposes of disclosure under Section 186(4) of the Companies

Act, 2013.

262 263