Page 263 - Tata Chemical Annual Report_2022-2023

P. 263

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

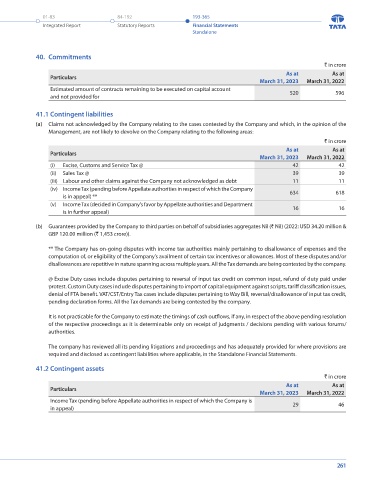

` in crore Total (150) - 152 228 33 13 18 15 7 11 135 69 8 6 121 96 150 - 15 15 - 75 28 36 - 1 13 11 15 (1) 165 706 - (701) (1) (1) 91 10 3 - 3 4 40. Commitments As at ` in crore

Transactions with Related parties (as defined under Ind AS 24) during the year ended March 31, 2023 and balances outstanding as at

As at

Key Management Personnel (KMP) - - - - - - - - - - - - - - - - - - - - - - - - - - 13 11 15 (1) - - - - - - 6 5 - - - - Particulars March 31, 2023 March 31, 2022

Estimated amount of contracts remaining to be executed on capital account

596

520

- - - - - - - - - - - - - - - - - - - - - - 28 36 - - - - - - 5 3 - - - - - 2 - - - - and not provided for

Other related parties

41.1 Contingent liabilities

-

-

-

-

-

-

15

-

150

-

-

15

3

1

82

-

-

-

152

-

-

-

-

1

15

-

4

4

1

-

147

1

8

6

19

2

2

2

4

(1)

(150)

(1)

Entities

Other

Tata Sons Private Ltd. Its Subsidiaries and Joint Ventures Tata Consultancy Services Limited - - - - - - 11 14 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 1 - - - - Management, are not likely to devolve on the Company relating to the following a

(a) Claims not acknowledged by the Company relating to the cases contested by the Company and which, in the opinion of the

As at

As at

Promoter Tata Sons Private Ltd. - - - - - - - - - - - - 14 1 11 - - - - - 10 - 10 - - - - - 102 - 81 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 3 - -

Excise, Customs and Service Tax @

(i)

42

42

39

39

Joint Venture of Tata Chemicals Limited Tata Indo Maroc Industries Phosphore Limited S.A. Morocco - - - - - - - - - - 92 28 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - (ii) Sales Tax @ 634 618

11

(iii) Labour and other claims against the Company not acknowledged as debt

11

(iv) Income Tax (pending before Appellate authorities in respect of which the Company

is in appeal) **

Natrium Holdings Limited - - - - - - - - - - - - - - 2 3 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

is in further appeal)

Tata Chemicals Europe Limited (4) (3) 1 1 1 1 (b) Guarantees provided by the Company to third parties on behalf of subsidiaries aggregates Nil (` Nil) (2022: USD 34.20 million &

- - - - - - - - - 1 - - - - - - - - - - - - - - - - - - - - - 701 - (701) - - - - - - - - GBP 120.00 million (` 1,453 crore)).

Homefield UK Private Limited, U.K. * - - 225 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - The sales to and purchases from related parties including other transactions with them are made in the normal course of business and on term

computation of, or eligibility of the Company’s availment of certain tax incentives or allowances. Most of these disputes and/or

disallowances are repetitive in nature spanning across multiple years. All the Tax demands are being contested by the company.

Subsidiaries of Tata Chemicals Limited Tata Chemicals Tata Chemicals International Pte. Magadi Limited, Limited, Singapore U.K - - 5 2 - - (2) (2) - 1 - - - - - - - - - - - - - - - - - - - - - - - - - - 3 1 - - 1 - The above figures do not include provision for Compensa

protest. Custom Duty cases include disputes pertaining to import of capital equipment against scripts, tariff classification issues,

denial of FTA benefit. VAT/CST/Entry Tax cases include disputes pertaining to Way Bill, reversal/disallowance of input tax credit,

Tata Chemicals North America Inc, United States of America - - - - - - (3) (2) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 1 1 pending declaration forms. All the Tax demands are being contested by the company.

It is not practicable for the Company to estimate the timings of cash outflows, if any, in respect of the above pending resolution

of the respective proceedings as it is determinable only on receipt of judgments / decisions pending with various forums/

Gusiute Holdings (UK) Limited - - - - - - - - - - - - - - - - - - - - - 75 - - - - - - - - - - - - - - - - - - - - For Guarantee to third parties on behalf of subsidiaries in related parties as at March 31, 2023 refer 41.1.(b) authorities.

The company has reviewed all its pending litigations and proceedings and has adequately provided for where provisions are

required and disclosed as contingent liabilities where applicable, in the Standalone Financial Statements.

Rallis India Limited, India - - - - 32 13 (3) (7) 2 3 29 29 - - - - - - - - - - - - - 1 - - - - 5 1 - - - - - - - - - 1 41.2 Contingent assets ` in crore

As at

As at

March 31, 2023 Transactions with related parties Loan reassignment/Investments redeemed/sales Purchase of goods (includes stock in transit) - Other services - expenses & (Reimbursement of Miscellaneous purchases/Services Investment in perpetual instrument Redemption of Preference shares Contributions to employee benefit trusts Other employees' related expenses Compensation to key Managerial Person Balances due from /to related parties Amount receivables/ad

Income Tax (pending before Appellate authorities in respect of which the Company is

46

29

in appeal)

Particulars (net of returns) Sales ( Net ) Other services - Income Dividend received Dividend paid Interest Received Short-term employee benefits Post-employment benefits As at March 31, 2023 As at March 31, 2022 Impairment of loans As at March 31, 2023 As at March 31, 2022 Deposit - Receivable/(payable) As at March 31, 2023 As at March 31, 2022 As at March 31, 2023 As at March 31, 2022 Interest Accrual As at March 31, 2023 As at March 31, 202

(b) Expenses) 1. 2. 3. 4. 5.

260 261