Page 122 - Tata Chemical Annual Report_2022-2023

P. 122

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Board's Report

Board‘s Report from continuing operations increased to ` 2,740 crore in Soda Ash demand is also driven by Solar Glass (used

in Solar Electricity generation) and Lithium Carbonate.

FY 2022-23 from ` 1,667 crore in FY 2021-22, up by 64%.

The Specialty Products will focus on maximising value with

3.2 Standalone: a sustainable portfolio, low carbon footprint Specialty Silica

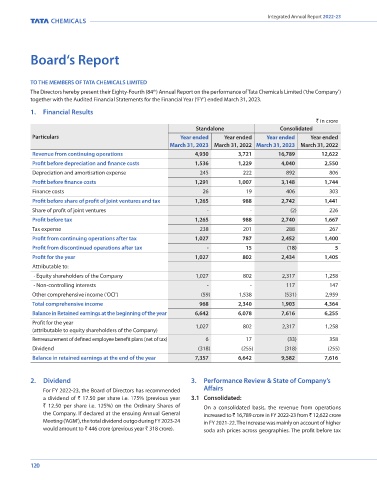

TO THE MEMBERS OF TATA CHEMICALS LIMITED

On a standalone basis, the revenue from operations and Prebiotics based on fermentation platform.

The Directors hereby present their Eighty-Fourth (84 ) Annual Report on the performance of Tata Chemicals Limited (‘the Company’)

th

together with the Audited Financial Statements for the Financial Year (‘FY’) ended March 31, 2023. increased to ` 4,930 crore in FY 2022-23 from

` 3,721 crore in FY 2021-22. The increase was mainly on 5.1 Basic Chemistry Products

1. Financial Results account of higher soda ash prices prevailing throughout Standalone (India)

` in crore the year. Profit before tax from continuing operations For FY 2022-23, the revenues from the Basic Chemistry

Standalone Consolidated stood at ` 1,265 crore in FY 2022-23 against ` 988 crore Products business stood at ` 4,698 crore, higher by 35%.

Particulars Year ended Year ended Year ended Year ended in FY 2021-22, up by 28%.

March 31, 2023 March 31, 2022 March 31, 2023 March 31, 2022 Soda Ash

For more details on the Consolidated and Standalone

Revenue from continuing operations 4,930 3,721 16,789 12,622 Indian soda ash demand remained steady during

performance, please refer to Management Discussion

Profit before depreciation and finance costs 1,536 1,229 4,040 2,550 & Analysis. FY 2022-23, growing at around 4.0-4.5%, driven mainly

Depreciation and amortisation expense 245 222 892 806 by container, flat and solar glass segments. Considering

annual solar installations of 20–25 GW, solar glass is

Profit before finance costs 1,291 1,007 3,148 1,744 4. Management Discussion & Analysis expected to remain a key demand driver. Increasing

Finance costs 26 19 406 303 The Management Discussion & Analysis, as required in supply chain costs and rise in global soda ash prices

terms of the Securities and Exchange Board of India (Listing

Profit before share of profit of joint ventures and tax 1,265 988 2,742 1,441 resulted in import parcels coming at higher prices.

Obligations and Disclosure Requirements) Regulations,

Share of profit of joint ventures - - (2) 226 2015 (‘SEBI Listing Regulations’), forms part of this Domestic availability remained normal with no major

Profit before tax 1,265 988 2,740 1,667 Integrated Annual Report. outages and high operating rates due to steady demand.

Availability of imported material was tight in the first half

Tax expense 238 201 288 267 of the year but started to ease in second half of the year

Profit from continuing operations after tax 1,027 787 2,452 1,400 5. Business Overview with easing of supply chains and lower ocean freight

The Company has two business segments viz. Basic

Profit from discontinued operations after tax - 15 (18) 5 rates. Coal prices remained volatile and surged after the

Chemistry Products and Specialty Products.

Profit for the year 1,027 802 2,434 1,405 Russia-Ukraine conflict. This kept the production costs

higher, though some of this was passed on to customers.

Attributable to: Basic Chemistry segment comprises inorganic chemicals Prices began to fall in the second half, but high inflationary

- Equity shareholders of the Company 1,027 802 2,317 1,258 led by Soda Ash, Salt and Sodium Bicarbonate. Scale, pressures kept demand and margins under control. Soda

supply chain efficiencies and customer relationships drive

- Non-controlling interests - - 117 147 ash realisations improved during FY 2022-23 resulting

this business. This segment has manufacturing operations

Other comprehensive income ('OCI') (59) 1,538 (531) 2,959 spread across four continents viz. North America (USA), in increase in revenues and EBITDA over FY 2021-22.

Total comprehensive income 968 2,340 1,903 4,364 Europe (UK), Africa (Kenya) and Asia (India). These inorganic Higher than expected demand coupled with supply

Balance in Retained earnings at the beginning of the year 6,642 6,078 7,616 6,255 chemicals primarily service industries such as Glass constraints and a pressure of increased input and energy

cost led to increased pricing.

Profit for the year 1,027 802 2,317 1,258 (Automotive, Architectural & Container), Detergent, Food,

(attributable to equity shareholders of the Company) Pharma, Animal Feed and Industrial Chemicals. Sales of soda ash for FY 2022-23 stood at 6.5 lakh Metric

Remeasurement of defined employee benefit plans (net of tax) 6 17 (33) 358 Tonne (‘MT’), a decrease of 5% over the previous year.

Specialty Products portfolio is driven by Chemistry-led

Dividend (318) (255) (318) (255) differentiation. The Company has three key products in

Balance in retained earnings at the end of the year 7,357 6,642 9,582 7,616 this segment comprising Specialty Silica, Prebiotics and Sodium Bicarbonate

Agri inputs. Specialty Silica range serves Food, Rubber and Sales of sodium bicarbonate stood at 1.2 lakh MT, same as

Tyre industry. Prebiotics and Formulations are targeted at last year.

2. Dividend 3. Performance Review & State of Company’s Food, Animal Feed and Pharmaceutical applications. Rallis

For FY 2022-23, the Board of Directors has recommended Affairs India Limited ('Rallis'), a listed subsidiary of the Company, The Company markets four value-added grades of

Bicarb – Medikarb (pharma grade), Sodakarb (food grade),

a dividend of ` 17.50 per share i.e. 175% (previous year 3.1 Consolidated: produces and markets range of Agri inputs including Seeds

` 12.50 per share i.e. 125%) on the Ordinary Shares of On a consolidated basis, the revenue from operations for Indian and overseas farmers. Alkakarb (feed grade) and Speckarb (industrial grade).

the Company. If declared at the ensuing Annual General increased to ` 16,789 crore in FY 2022-23 from ` 12,622 crore Salt

Meeting (‘AGM’), the total dividend outgo during FY 2023-24 in FY 2021-22. The increase was mainly on account of higher The Company is increasing its focus on Green Chemistry

would amount to ` 446 crore (previous year ` 318 crore). soda ash prices across geographies. The profit before tax with Sustainability as a key driver of value. Basic Chemistry The demand for salt was higher from the Company’s key

will scale further by adding capacities of the core products customer, Tata Consumer Products Limited, during the year

and leveraging cost competitiveness. The growth in and the production was increased appropriately to meet

120 121