Page 250 - Tata_Chemicals_yearly-reports-2021-22

P. 250

Integrated Annual Report 2021-22

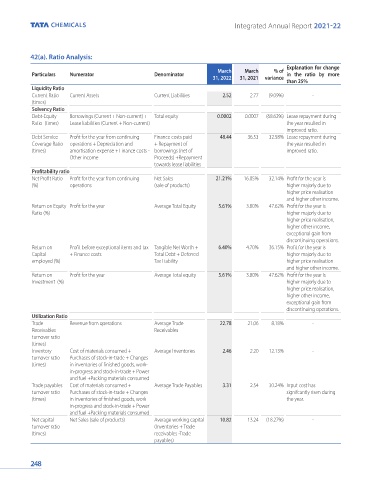

42(a). Ratio Analysis:

Explanation for change

March March % of

Particulars Numerator Denominator in the ratio by more

31, 2022 31, 2021 variance

than 25%

Liquidity Ratio

Current Ratio Current Assets Current Liabilities 2.52 2.77 (9.09%) -

(times)

Solvency Ratio

Debt-Equity Borrowings (Current + Non-current) + Total equity 0.0002 0.0007 (68.62%) Lease repayment during

Ratio (times) Lease liabilities (Current + Non-current) the year resulted in

improved ratio.

Debt Service Profit for the year from continuing Finance costs paid 48.44 36.53 32.58% Lease repayment during

Coverage Ratio operations + Depreciation and + Repayment of the year resulted in

(times) amortisation expense + Finance costs - borrowings (net of improved ratio.

Other income Proceeds) +Repayment

towards lease liabilities

Profitability ratio

Net Profit Ratio Profit for the year from continuing Net Sales 21.21% 16.05% 32.14% Profit for the year is

(%) operations (sale of products) higher majorly due to

higher price realisation

and higher other income.

Return on Equity Profit for the year Average Total Equity 5.61% 3.80% 47.62% Profit for the year is

Ratio (%) higher majorly due to

higher price realisation,

higher other income,

exceptional gain from

discontinuing operations.

Return on Profit before exceptional items and tax Tangible Net Worth + 6.40% 4.70% 36.15% Profit for the year is

Capital + Finance costs Total Debt + Deferred higher majorly due to

employed (%) Tax Liability higher price realisation

and higher other income.

Return on Profit for the year Average Total equity 5.61% 3.80% 47.62% Profit for the year is

Investment (%) higher majorly due to

higher price realisation,

higher other income,

exceptional gain from

discontinuing operations.

Utilization Ratio

Trade Revenue from operations Average Trade 22.78 21.06 8.18% -

Receivables Receivables

turnover ratio

(times)

Inventory Cost of materials consumed + Average Inventories 2.46 2.20 12.13% -

turnover ratio Purchases of stock-in-trade + Changes

(times) in inventories of finished goods, work-

in-progress and stock-in-trade + Power

and fuel +Packing materials consumed

Trade payables Cost of materials consumed + Average Trade Payables 3.31 2.54 30.24% Input cost has

turnover ratio Purchases of stock-in-trade + Changes signifcantly risen during

(times) in inventories of finished goods, work- the year.

in-progress and stock-in-trade + Power

and fuel +Packing materials consumed

Net capital Net Sales (sale of products) Average working capital 10.82 13.24 (18.27%) -

turnover ratio (Inventories + Trade

(times) receivables -Trade

payables)

248