Page 248 - Tata_Chemicals_yearly-reports-2021-22

P. 248

Integrated Annual Report 2021-22

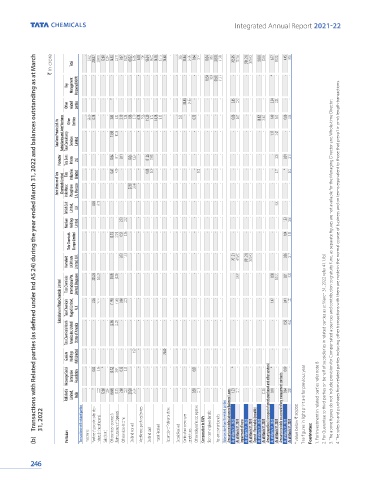

Transactions with Related parties (as defined under Ind AS 24) during the year ended March 31, 2022 and balances outstanding as at March

` in crore Total - 39.60 228.37 299.79 12.80 12.54 14.63 20.18 9.67 18.28 69.27 63.85 6.18 7.96 96.54 96.70 14.78 13.13 74.60 - - 0.83 35.84 24.95 0.64 0.14 10.54 9.59 (0.51) (1.31) 705.95 737.63 (701.21) (676.40) (0.82) (0.95) 6.77 192.86 4.45 9.56

Key Management Personnel (KMP) - - - - - - - - - - - - - - - - - - - - - - - - - - 10.54 9.59 (0.51) (1.31) - - - - - - * - - -

- - - - - - * - - - - - - - - - - - - - - - 35.84 24.95 - - - - - - 2.85 0.42 - - - - 2.24 2.20 - -

Other related parties - 39.60 0.78 - - - 3.83 5.32 2.10 11.34 1.96 0.79 6.18 7.96 15.20 16.72 14.78 13.13 - - - 0.83 - - 0.13 - - - - - 0.66 0.67 - - (0.82) (0.83) 1.49 1.63 0.06 4.98

Tata Sons Private Ltd. Its Subsidiaries and Joint Ventures Tata Consultancy Other Services Entities Limited - - - - - - 13.98 10.28 - - - - - - - - - - - - - - - - - - - - - - - - - - - - 1.17 2.45 - -

10.24 - -

10.24

Promoter Tata Sons Private Ltd. - - - - - - - - - 10.64 9.17 0.11 - - - - - - - 81.26 79.89 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 0.03 0.01 * 0.16

- - -

0.08

- - - -

- - -

Joint Venture of Tata Chemicals Limited Tata Indo Maroc Industries Phosphore Limited S.A. Morocco - - - - - - - 0.47 4.70 - - - 27.87 26.49 - - - - - 0.09 - - - - - - - - - - 0.03 - - - - - - - - - - - - 0.77 - - 0.02

British Salt Limited, U.K - - 0.04 0.18 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 0.04 - -

Natrium Holdings Limited - - - - - - - - - 2.72 2.32 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 1.33 0.66

- - -

- - - -

- - -

Tata Chemicals Europe Limited (3.13) (3.24) 0.51 0.36 - - - - - - - 1.04 1.15

- -

- - - - - - - - 0.72 1.31 - - - - - - - - - - - - - - - - - - - - 701.21 676.40 (676.40) - - - - 0.36 0.17

Homefield UK Private Limited, U.K. (701.21) 4. The sales to and purchases from related parties including other transactions with them are made in the normal course of business and on terms equivalent to those that prevail in arm’s length transactions.

- - 225.24 285.29 - - (0.05) (0.06) - - - - - - - - - - - - - - - - - - - - - - - 59.97 - - - - 0.30 185.74 0.01 0.02 3. The above figures do not include provision for Compensated absences and contribution to gratuity fund, as separate figures are not available for the Managing Director and Whole-time Director.

International Pte.

Limited, Singapore

Tata Chemicals

Subsidiaries of Tata Chemicals Limited Tata Chemicals Magadi Limited, U.K - - 2.26 14.14 - - (1.95) (1.56) 0.60 2.01 - - - - - - - - - - - - - - - - - - - - - - - - - - 1.47 - 0.41 1.00

Tata Chemicals North America Inc, United States of America - - - - - - (2.36) (2.25) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 0.50 0.82

Gusiute Holdings (UK) Limited - - - - - - - - - - - 1.99 - - - - - - 74.60 - - - - - - - - - - - - - - - - - - - - - 2. For Guarantee to third parties on behalf of subsidiaries in related parties as at March 31, 2022 refer 41.1.(b)

Ncourage Social Enterprise Foundation - - 0.05 0.16 * - (0.12) (0.01) 0.23 0.51 - - - - - - - - - - - - - - 0.01 - - - - - * - - - - - * - 0.09 -

Rallis India Limited, India - - * 0.02 12.80 12.54 (6.68) (2.17) 2.68 0.43 29.20 24.34 - - - - - - - - - - - - 0.50 0.11 - - - - 1.23 0.17 - - - (0.12) Amount payables ( in respect of goods purchased and other services) 0.10 - 0.64 0.58 The figures in light print are for previous year 1. For Investment in related parties refer note 8

31, 2022 Transactions with related parties Purchase of goods (includes stock Miscellaneous purchases/Services Other employees' related expenses Balances due from /to related parties Amount receivables/advances/balances/ Loans Amount receivable on account of any management contracts * value below ` 50,000

in transit) - (net of returns) Other services - expenses & (Reimbursement of Expenses) Other services - Income Dividend received Interest Received Redemption of Preference shares Deposit Received Contributions to employee Compensation to KMPs Short-term employee benefits Post-employment benefits As at March 31, 2022 As at March 31, 2021 Impairment of loans As at March 31, 2022 As at March 31, 2021 Deposit - Receivabl

(b) Particulars Investments Sales ( Net ) Dividend paid benefit trusts

246