Page 249 - Tata_Chemicals_yearly-reports-2021-22

P. 249

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

REPORTS

REPORT

STATEMENTS

Standalone

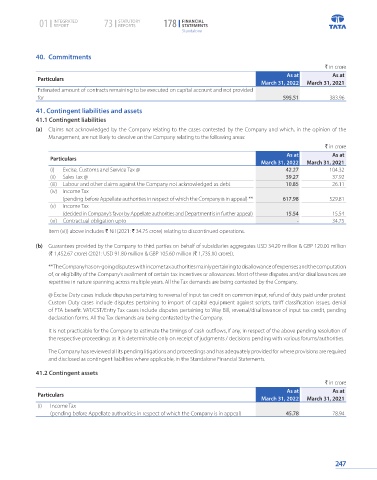

40. Commitments

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

Estimated amount of contracts remaining to be executed on capital account and not provided

for 595.51 383.96

41. Contingent liabilities and assets

41.1 Contingent liabilities

(a) Claims not acknowledged by the Company relating to the cases contested by the Company and which, in the opinion of the

Management, are not likely to devolve on the Company relating to the following areas:

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

(i) Excise, Customs and Service Tax @ 42.27 104.32

(ii) Sales Tax @ 39.27 37.92

(iii) Labour and other claims against the Company not acknowledged as debt 10.85 26.11

(iv) Income Tax

(pending before Appellate authorities in respect of which the Company is in appeal) ** 617.98 529.81

(v) Income Tax

(decided in Company's favor by Appellate authorities and Department is in further appeal) 15.54 15.54

(vi) Contractual obligation upto - 34.75

Item (vi)) above includes ` Nil (2021: ` 34.75 crore) relating to discontinued operations.

(b) Guarantees provided by the Company to third parties on behalf of subsidiaries aggregates USD 34.20 million & GBP 120.00 million

(` 1,452.67 crore) (2021: USD 91.80 million & GBP 105.60 million (` 1,735.10 crore)).

** The Company has on-going disputes with income tax authorities mainly pertaining to disallowance of expenses and the computation

of, or eligibility of the Company’s availment of certain tax incentives or allowances. Most of these disputes and/or disallowances are

repetitive in nature spanning across multiple years. All the Tax demands are being contested by the Company.

@ Excise Duty cases include disputes pertaining to reversal of input tax credit on common input, refund of duty paid under protest.

Custom Duty cases include disputes pertaining to import of capital equipment against scripts, tariff classification issues, denial

of FTA benefit. VAT/CST/Entry Tax cases include disputes pertaining to Way Bill, reversal/disallowance of input tax credit, pending

declaration forms. All the Tax demands are being contested by the Company.

It is not practicable for the Company to estimate the timings of cash outflows, if any, in respect of the above pending resolution of

the respective proceedings as it is determinable only on receipt of judgments / decisions pending with various forums/authorities.

The Company has reviewed all its pending litigations and proceedings and has adequately provided for where provisions are required

and disclosed as contingent liabilities where applicable, in the Standalone Financial Statements.

41.2 Contingent assets

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

(i) Income Tax

(pending before Appellate authorities in respect of which the Company is in appeal) 45.78 78.94

247