Page 114 - Tata_Chemicals_yearly-reports-2021-22

P. 114

Integrated Annual Report 2021-22

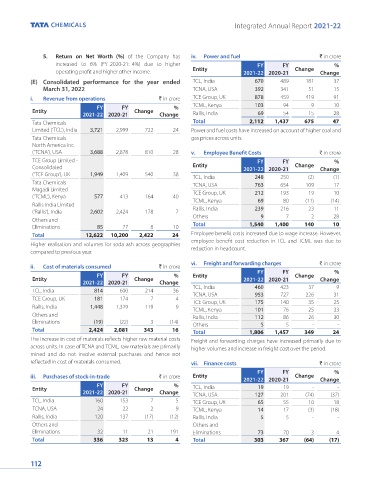

5. Return on Net Worth (%) of the Company has iv. Power and fuel ` in crore

increased to 6% (FY 2020-21: 4%) due to higher FY FY %

operating profit and higher other income. Entity 2021-22 2020-21 Change Change

(E) Consolidated performance for the year ended TCL, India 670 489 181 37

March 31, 2022 TCNA, USA 392 341 51 15

i. Revenue from operations ` in crore TCE Group, UK 878 459 419 91

FY FY % TCML, Kenya 103 94 9 10

Entity Change

2021-22 2020-21 Change Rallis, India 69 54 15 28

Tata Chemicals Total 2,112 1,437 675 47

Limited (‘TCL’), India 3,721 2,999 722 24 Power and fuel costs have increased on account of higher coal and

Tata Chemicals gas prices across units.

North America Inc.

(‘TCNA’), USA 3,688 2,878 810 28 v. Employee Benefit Costs ` in crore

TCE Group Limited - FY FY %

Consolidated Entity 2021-22 2020-21 Change Change

(‘TCE Group’), UK 1,949 1,409 540 38 TCL, India 248 250 (2) (1)

Tata Chemicals TCNA, USA 763 654 109 17

Magadi Limited TCE Group, UK 212 193 19 10

(‘TCML’), Kenya 577 413 164 40 69

Rallis India Limited TCML, Kenya 80 (11) (14)

(‘Rallis’), India 2,602 2,424 178 7 Rallis, India 239 216 23 11

Others and Others 9 7 2 28

Eliminations 85 77 8 10 Total 1,540 1,400 140 10

Total 12,622 10,200 2,422 24 Employee benefit costs increased due to wage increase. However,

employee benefit cost reduction in TCL and TCML was due to

Higher realisation and volumes for soda ash across geographies

compared to previous year. reduction in headcount.

vi. Freight and forwarding charges ` in crore

ii. Cost of materials consumed ` in crore

FY FY % Entity FY FY Change %

Entity Change 2021-22 2020-21 Change

2021-22 2020-21 Change

TCL, India 814 600 214 36 TCL, India 460 423 37 9

953

TCE Group, UK 181 174 7 4 TCNA, USA 175 727 226 31

25

TCE Group, UK

140

35

Rallis, India 1,448 1,329 119 9 TCML, Kenya 101 76 25 33

Others and Rallis, India 112 86 26 30

Eliminations (19) (22) 3 (14) Others 5 5 - -

Total 2,424 2,081 343 16 Total 1,806 1,457 349 24

The increase in cost of materials reflects higher raw material costs Freight and forwarding charges have increased primarily due to

across units. In case of TCNA and TCML, raw materials are primarily higher volumes and increase in freight cost over the period.

mined and do not involve external purchases and hence not

reflected in cost of materials consumed. vii. Finance costs ` in crore

FY FY %

iii. Purchases of stock-in-trade ` in crore Entity 2021-22 2020-21 Change Change

FY FY %

Entity Change TCL, India 19 19 - -

2021-22 2020-21 Change TCNA, USA 127 201 (74) (37)

TCL, India 160 153 7 5 TCE Group, UK 65 55 10 18

TCNA, USA 24 22 2 9 TCML, Kenya 14 17 (3) (18)

Rallis, India 120 137 (17) (12) Rallis, India 5 5 - -

Others and Others and

Eliminations 32 11 21 191 Eliminations 73 70 3 4

Total 336 323 13 4 Total 303 367 (64) (17)

112