Page 113 - Tata_Chemicals_yearly-reports-2021-22

P. 113

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

REPORTS

REPORT

STATEMENTS

Management Discussion

& Analysis

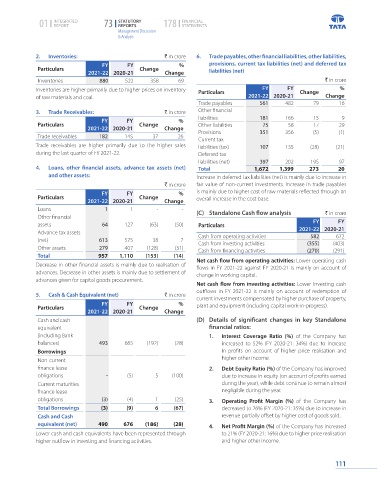

2. Inventories: ` in crore 6. Trade payables, other financial liabilities, other liabilities,

FY FY % provisions, current tax liabilities (net) and deferred tax

Particulars Change liabilities (net)

2021-22 2020-21 Change

Inventories 880 522 358 69 ` in crore

Inventories are higher primarily due to higher prices on inventory Particulars FY FY Change %

of raw materials and coal. 2021-22 2020-21 Change

Trade payables 561 482 79 16

3. Trade Receivables: ` in crore Other financial

liabilities 181 166 15 9

FY FY %

Particulars Change Other liabilities 75 58 17 29

2021-22 2020-21 Change

Trade receivables 182 145 37 26 Provisions 351 356 (5) (1)

Current tax

Trade receivables are higher primarily due to the higher sales liabilities (tax) 107 135 (28) (21)

during the last quarter of FY 2021-22. Deferred tax

liabilities (net) 397 202 195 97

4. Loans, other financial assets, advance tax assets (net) Total 1,672 1,399 273 20

and other assets: Increase in deferred tax liabilities (net) is mainly due to increase in

` in crore fair value of non-current investments. Increase in trade payables

FY FY % is mainly due to higher cost of raw materials reflected through an

Particulars Change overall increase in the cost base.

2021-22 2020-21 Change

Loans 1 1 - - (C) Standalone Cash flow analysis ` in crore

Other financial

assets 64 127 (63) (50) Particulars FY FY

Advance tax assets Cash from operating activities 2021-22 2020-21

582

672

(net) 613 575 38 7 Cash from investing activities (355) (403)

Other assets 279 407 (128) (31) Cash from financing activities (270) (291)

Total 957 1,110 (153) (14)

Decrease in other financial assets is mainly due to realisation of Net cash flow from operating activities: Lower operating cash

flows in FY 2021-22 against FY 2020-21 is mainly on account of

advances. Decrease in other assets is mainly due to settlement of change in working capital.

advances given for capital goods procurement.

Net cash flow from investing activities: Lower investing cash

outflows in FY 2021-22 is mainly on account of redemption of

5. Cash & Cash Equivalent (net) ` in crore

current investments compensated by higher purchase of property,

FY FY %

Particulars Change plant and equipment (including capital work-in-progress).

2021-22 2020-21 Change

Cash and cash (D) Details of significant changes in key Standalone

equivalent financial ratios:

(including Bank 1. Interest Coverage Ratio (%) of the Company has

balances) 493 685 (192) (28) increased to 52% (FY 2020-21: 34%) due to increase

Borrowings in profits on account of higher price realisation and

Non-current higher other income.

finance lease 2. Debt Equity Ratio (%) of the Company has improved

obligations - (5) 5 (100) due to increase in equity (on account of profits earned

Current maturities during the year), while debt continue to remain almost

finance lease negligible during the year.

obligations (3) (4) 1 (25) 3. Operating Profit Margin (%) of the Company has

Total Borrowings (3) (9) 6 (67) decreased to 26% (FY 2020-21: 35%) due to increase in

Cash and Cash revenue partially offset by higher cost of goods sold.

equivalent (net) 490 676 (186) (28) 4. Net Profit Margin (%) of the Company has increased

Lower cash and cash equivalents have been represented through to 21% (FY 2020-21: 16%) due to higher price realisation

higher outflow in investing and financing activities. and higher other income.

111