Page 112 - Tata_Chemicals_yearly-reports-2021-22

P. 112

Integrated Annual Report 2021-22

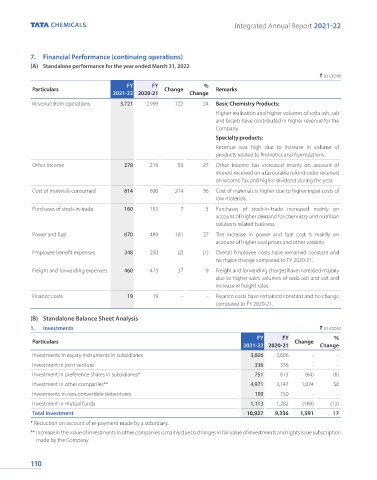

7. Financial Performance (continuing operations)

(A) Standalone performance for the year ended March 31, 2022

` in crore

FY FY %

Particulars Change Remarks

2021-22 2020-21 Change

Revenue from operations 3,721 2,999 722 24 Basic Chemistry Products:

Higher realisation and higher volumes of soda ash, salt

and bicarb have contributed in higher revenue for the

Company.

Specialty products:

Revenue was high due to increase in volume of

products related to Prebiotics and Formulations.

Other Income 278 219 59 27 Other income has increased mainly on account of

interest received on a favourable refund order received

on Income Tax and higher dividend during the year.

Cost of materials consumed 814 600 214 36 Cost of materials is higher due to higher input costs of

raw materials.

Purchases of stock-in-trade 160 153 7 5 Purchases of stock-in-trade increased mainly on

account of higher demand for chemistry and nutrition

solutions related business.

Power and fuel 670 489 181 37 The increase in power and fuel cost is mainly on

account of higher coal prices and other variants.

Employee benefit expenses 248 250 (2) (1) Overall Employee costs have remained constant and

no major change compared to FY 2020-21.

Freight and forwarding expenses 460 423 37 9 Freight and forwarding charges have increased majorly

due to higher sales volumes of soda ash and salt and

increase in freight rates.

Finance costs 19 19 - - Finance costs have remained constant and no change

compared to FY 2020-21.

(B) Standalone Balance Sheet Analysis

1. Investments ` in crore

FY FY %

Particulars Change

2021-22 2020-21 Change

Investments in equity instruments in subsidiaries 3,606 3,606 - -

Investment in joint venture 336 336 - -

Investment in preference shares in subsidiaries* 751 815 (64) (8)

Investment in other companies** 4,971 3,147 1,824 58

Investments in non-convertible debentures 150 150 - -

Investment in mutual funds 1,113 1,282 (169) (13)

Total Investment 10,927 9,336 1,591 17

* Reduction on account of re-payment made by a subsidiary.

** Increase in the value of investments in other companies is mainly due to changes in fair value of investments and rights issue subscription

made by the Company.

110