Page 212 - Tata_Chemicals_yearly-reports-2020-2021

P. 212

Integrated Annual Report 2020-21

Financial instruments and cash deposits

Credit risk from balances/investments with banks and financial institutions is managed in accordance with the Company’s treasury

risk management policy. Investments of surplus funds are made only with approved counterparties and within limits assigned to

each counterparty. The limits are assigned based on corpus of investable surplus and corpus of the investment avenue. The limits

are set to minimize the concentration of risks and therefore mitigate financial loss through counterparty’s potential failure to make

payments.

Financial guarantees

Financial guarantees disclosed in note 45.1(b) have been provided as corporate guarantees to financial institutions and banks that

have extended credit facilities to the Company's subsidiaries. In this regard, the Company does not foresee any significant credit risk

exposure.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they become due. The objective of

liquidity risk management is to maintain sufficient liquidity and ensure that funds are available for use as and when required.

The Treasury Risk Management Policy includes an appropriate liquidity risk management framework for the management of the

short-term, medium-term and long term funding and cash management requirements. The Company manages the liquidity risk

by maintaining adequate cash reserves, banking facilities and reserve borrowing facilities, by continuously monitoring forecast and

actual cash flows, and by matching the maturity profiles of financial assets and liabilities. The Company invests its surplus funds in

bank fixed deposit and liquid schemes of mutual funds, which carry no/negligible mark to market risks.

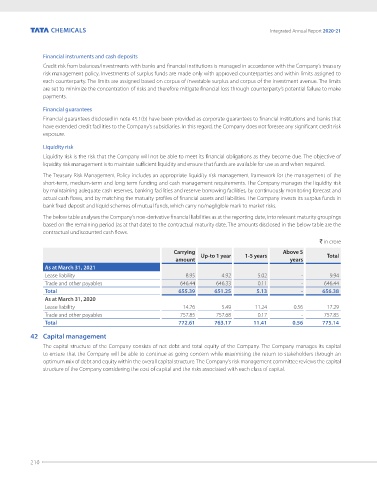

The below table analyses the Company’s non-derivative financial liabilities as at the reporting date, into relevant maturity groupings

based on the remaining period (as at that date) to the contractual maturity date. The amounts disclosed in the below table are the

contractual undiscounted cash flows.

` in crore

Carrying Up-to 1 year 1-5 years Above 5 Total

amount years

As at March 31, 2021

Lease liability 8.95 4.92 5.02 - 9.94

Trade and other payables 646.44 646.33 0.11 - 646.44

Total 655.39 651.25 5.13 - 656.38

As at March 31, 2020

Lease liability 14.76 5.49 11.24 0.56 17.29

Trade and other payables 757.85 757.68 0.17 - 757.85

Total 772.61 763.17 11.41 0.56 775.14

42 Capital management

The capital structure of the Company consists of net debt and total equity of the Company. The Company manages its capital

to ensure that the Company will be able to continue as going concern while maximising the return to stakeholders through an

optimum mix of debt and equity within the overall capital structure. The Company's risk management committee reviews the capital

structure of the Company considering the cost of capital and the risks associated with each class of capital.

210