Page 209 - Tata_Chemicals_yearly-reports-2020-2021

P. 209

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Standalone

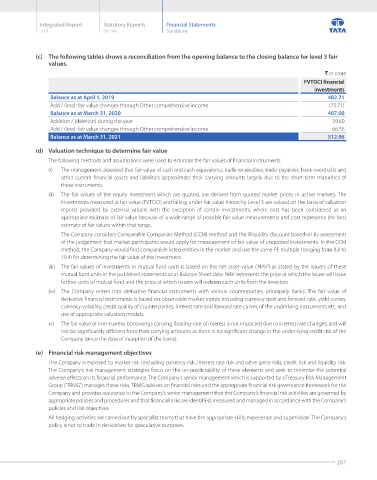

(c) The following tables shows a reconciliation from the opening balance to the closing balance for level 3 fair

values.

` in crore

FVTOCI financial

investments

Balance as at April 1, 2019 482.71

Add / (less): fair value changes through Other comprehensive income (75.71)

Balance as at March 31, 2020 407.00

Addition / (deletion) during the year 39.60

Add / (less): fair value changes through Other comprehensive income 66.36

Balance as at March 31, 2021 512.96

(d) Valuation technique to determine fair value

The following methods and assumptions were used to estimate the fair values of financial instruments:

(i) The management assessed that fair value of cash and cash equivalents, trade receivables, trade payables, bank overdrafts and

other current financial assets and liabilities approximate their carrying amounts largely due to the short-term maturities of

these instruments.

(ii) The fair values of the equity investment which are quoted, are derived from quoted market prices in active markets. The

Investments measured at fair value (FVTOCI) and falling under fair value hierarchy Level 3 are valued on the basis of valuation

reports provided by external valuers with the exception of certain investments, where cost has been considered as an

appropriate estimate of fair value because of a wide range of possible fair value measurements and cost represents the best

estimate of fair values within that range.

The Company considers Comparable Companies Method (CCM) method and the illiquidity discount based on its assessment

of the judgement that market participants would apply for measurement of fair value of unquoted investments. In the CCM

method, the Company would find comparable listed entities in the market and use the same PE multiple (ranging from 8.8 to

19.4) for determining the fair value of the investment.

(iii) The fair values of investments in mutual fund units is based on the net asset value (‘NAV’) as stated by the issuers of these

mutual fund units in the published statements as at Balance Sheet date. NAV represents the price at which the issuer will issue

further units of mutual fund and the price at which issuers will redeem such units from the investors.

(iv) The Company enters into derivative financial instruments with various counterparties, principally banks. The fair value of

derivative financial instruments is based on observable market inputs including currency spot and forward rate, yield curves,

currency volatility, credit quality of counterparties, interest rate and forward rate curves of the underlying instruments etc. and

use of appropriate valuation models.

(v) The fair value of non-current borrowings carrying floating-rate of interest is not impacted due to interest rate changes, and will

not be significantly different from their carrying amounts as there is no significant change in the under-lying credit risk of the

Company (since the date of inception of the loans).

(e) Financial risk management objectives

The Company is exposed to market risk (including currency risk, interest rate risk and other price risk), credit risk and liquidity risk.

The Company’s risk management strategies focus on the un-predictability of these elements and seek to minimise the potential

adverse effects on its financial performance. The Company’s senior management which is supported by a Treasury Risk Management

Group ('TRMG') manages these risks. TRMG advises on financial risks and the appropriate financial risk governance framework for the

Company and provides assurance to the Company’s senior management that the Company’s financial risk activities are governed by

appropriate policies and procedures and that financial risks are identified, measured and managed in accordance with the Company’s

policies and risk objectives.

All hedging activities are carried out by specialist teams that have the appropriate skills, experience and supervision. The Company’s

policy is not to trade in derivatives for speculative purposes.

207