Page 298 - Tata_Chemicals_yearly-reports-2019-20

P. 298

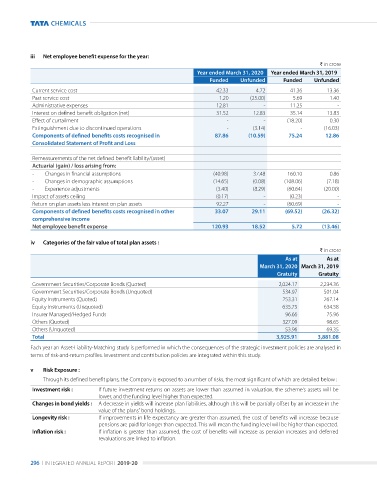

iii Net employee benefit expense for the year:

` in crore

Year ended March 31, 2020 Year ended March 31, 2019

Funded Unfunded Funded Unfunded

Current service cost 42.33 4.72 41.36 13.36

past service cost 1.20 (25.00) 5.69 1.40

administrative expenses 12.81 - 11.25 -

Interest on defined benefit obligation (net) 31.52 12.83 35.14 13.83

effect of curtailment - - (18.20) 0.30

extinguishment due to discontinued operations - (3.14) - (16.03)

Components of defined benefits costs recognised in 87.86 (10.59) 75.24 12.86

Consolidated Statement of Profit and Loss

remeasurements of the net defined benefit liability/(asset)

Actuarial (gain) / loss arising from:

- Changes in financial assumptions (40.98) 37.48 160.10 0.86

- Changes in demographic assumptions (14.65) (0.08) (108.06) (7.18)

- experience adjustments (3.40) (8.29) (60.64) (20.00)

Impact of assets ceiling (0.17) - (0.23) -

return on plan assets less interest on plan assets 92.27 - (60.69) -

Components of defined benefits costs recognised in other 33.07 29.11 (69.52) (26.32)

comprehensive income

Net employee benefit expense 120.93 18.52 5.72 (13.46)

iv Categories of the fair value of total plan assets :

` in crore

As at As at

March 31, 2020 March 31, 2019

Gratuity Gratuity

government Securities/Corporate Bonds (Quoted) 2,024.17 2,234.36

government Securities/Corporate Bonds (unquoted) 534.97 501.04

equity Instruments (Quoted) 253.31 267.14

equity Instruments (unquoted) 635.75 634.58

Insurer Managed/Hedged Funds 96.66 75.96

others (Quoted) 327.09 98.65

others (unquoted) 53.96 69.35

Total 3,925.91 3,881.08

each year an asset-liability-Matching study is performed in which the consequences of the strategic investment policies are analysed in

terms of risk-and-return profiles. Investment and contribution policies are integrated within this study.

v Risk Exposure :

through its defined benefit plans, the Company is exposed to a number of risks, the most significant of which are detailed below :

Investment risk : If future investment returns on assets are lower than assumed in valuation, the scheme's assets will be

lower, and the funding level higher than expected.

Changes in bond yields : a decrease in yields will increase plan liabilities, although this will be partially offset by an increase in the

value of the plans' bond holdings.

Longevity risk : If improvements in life expectancy are greater than assumed, the cost of benefits will increase because

pensions are paid for longer than expected. this will mean the funding level will be higher than expected.

Inflation risk : If inflation is greater than assumed, the cost of benefits will increase as pension increases and deferred

revaluations are linked to inflation.

296 I Integrated annual report 2019-20