Page 289 - Tata_Chemicals_yearly-reports-2019-20

P. 289

Integrated report Statutory reportS Financial StatementS

Consolidated

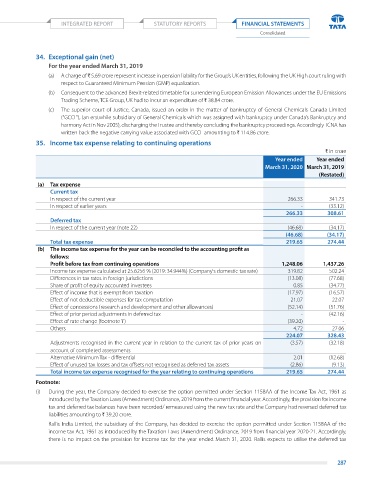

34. Exceptional gain (net)

For the year ended March 31, 2019

(a) a charge of ` 5.69 crore represent increase in pension liability for the group’s uK entities, following the uK High court ruling with

respect to guaranteed Minimum pension (gMp) equalization.

(b) Consequent to the advanced Brexit-related timetable for surrendering european emission allowances under the eu emissions

trading Scheme, tCe group, uK had to incur an expenditure of ` 38.84 crore.

(c) the superior court of Justice, Canada, issued an order in the matter of bankruptcy of general Chemicals Canada limited

(“gCCl”), (an erstwhile subsidiary of general Chemicals which was assigned with bankruptcy under Canada’s Bankruptcy and

harmony act in nov 2005), discharging the trustee and thereby concluding the bankruptcy proceedings. accordingly tCna has

written back the negative carrying value associated with gCCl amounting to ` 114.86 crore.

35. Income tax expense relating to continuing operations

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

(a) Tax expense

Current tax

In respect of the current year 266.33 341.73

In respect of earlier years - (33.12)

266.33 308.61

Deferred tax

In respect of the current year (note 22) (46.68) (34.17)

(46.68) (34.17)

Total tax expense 219.65 274.44

(b) The income tax expense for the year can be reconciled to the accounting profit as

follows:

Profit before tax from continuing operations 1,248.06 1,437.26

Income tax expense calculated at 25.6256 % (2019: 34.944%) (Company's domestic tax rate) 319.82 502.24

differences in tax rates in foreign jurisdictions (13.08) (77.68)

Share of profit of equity accounted investees 0.85 (34.77)

effect of income that is exempt from taxation (17.97) (16.57)

effect of not deductible expenses for tax computation 21.07 22.07

effect of concessions (research and development and other allowances) (52.14) (51.76)

effect of prior period adjustments in deferred tax - (42.16)

effect of rate change (footnote 'i') (39.20) -

others 4.72 27.06

224.07 328.43

adjustments recognised in the current year in relation to the current tax of prior years on (3.57) (32.18)

account of completed assessments

alternative Minimum tax - differential 2.01 (12.68)

effect of unused tax losses and tax offsets not recognised as deferred tax assets (2.86) (9.13)

Total income tax expense recognised for the year relating to continuing operations 219.65 274.44

Footnote:

(i) during the year, the Company decided to exercise the option permitted under Section 115Baa of the Income tax act, 1961 as

introduced by the taxation laws (amendment) ordinance, 2019 from the current financial year. accordingly, the provision for income

tax and deferred tax balances have been recorded/ remeasured using the new tax rate and the Company had reversed deferred tax

liabilities amounting to ` 39.20 crore.

rallis India limited, the subsidiary of the Company, has decided to exercise the option permitted under Section 1158aa of the

income tax act, 1961 as introduced by the taxation laws (amendment) ordinance, 2019 from financial year 2020-21. accordingly,

there is no impact on the provision for income tax for the year ended March 31, 2020. rallis expects to utilise the deferred tax

287