Page 286 - Tata_Chemicals_yearly-reports-2019-20

P. 286

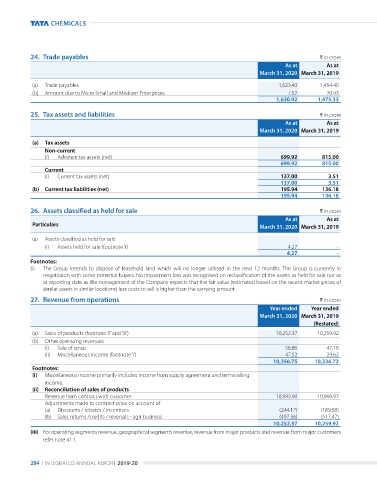

24. Trade payables ` in crore

As at As at

March 31, 2020 March 31, 2019

(a) trade payables 1,623.40 1,454.40

(b) amount due to Micro Small and Medium enterprises 7.52 20.93

1,630.92 1,475.33

25. Tax assets and liabilities ` in crore

As at As at

March 31, 2020 March 31, 2019

(a) Tax assets

Non-current

(i) advance tax assets (net) 699.92 815.00

699.92 815.00

Current

(i) Current tax assets (net) 137.00 3.51

137.00 3.51

(b) Current tax liabilities (net) 195.94 136.18

195.94 136.18

26. Assets classified as held for sale ` in crore

As at As at

Particulars March 31, 2020 March 31, 2019

(a) assets classified as held for sale

(i) assets held for sale (footnote ‘i’) 4.27 -

4.27 -

Footnotes:

(i) the group intends to dispose of leasehold land which will no longer utilised in the next 12 months. the group is currently in

negotiation with some potential buyers. no impairment loss was recognised on reclassification of the assets as held for sale nor as

at reporting date as the management of the Company expects that the fair value (estimated based on the recent market prices of

similar assets in similar locations) less costs to sell is higher than the carrying amount.

27. Revenue from operations ` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

(a) Sales of products (footnote ‘ii’ and ‘iii’) 10,252.37 10,259.92

(b) other operating revenues

(i) Sale of scrap 56.86 47.18

(ii) Miscellaneous income (footnote ‘i’) 47.52 29.62

10,356.75 10,336.72

Footnotes:

(i) Miscellaneous income primarily includes income from supply agreement and terminalling

Income.

(ii) Reconciliation of sales of products

revenue from contract with customer 10,993.90 10,966.97

adjustments made to contract price on account of

(a) discounts / rebates / incentives (244.17) (189.58)

(b) Sales returns /credits / reversals - agri business (497.36) (517.47)

10,252.37 10,259.92

(iii) For operating segments revenue, geographical segments revenue, revenue from major products and revenue from major customers

refer note 41.1.

284 I Integrated annual report 2019-20