Page 285 - Tata_Chemicals_yearly-reports-2019-20

P. 285

Integrated report Statutory reportS Financial StatementS

Consolidated

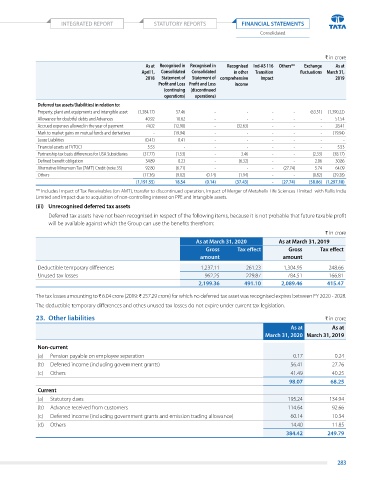

` in crore

As at Recognised in Recognised in Recognised Ind-AS 116 Others** Exchange As at

April 1, Consolidated Consolidated in other Transition fluctuations March 31,

2018 Statement of Statement of comprehensive Impact 2019

Profit and Loss Profit and Loss income

(continuing (discontinued

operations) operations)

Deferred tax assets/(liabilities) in relation to:

property, plant and equipments and intangible asset (1,384.17) 57.46 - - - - (63.51) (1,390.22)

allowance for doubtful debts and advances 40.92 10.62 - - - - - 51.54

accrued expenses allowed in the year of payment 74.02 (12.98) - (32.63) - - - 28.41

Mark to market gains on mutual funds and derivatives - (19.94) - - - - - (19.94)

lease liabilities (0.41) 0.41 - - - - - -

Financial assets at FVtoCI 5.53 - - - - - - 5.53

partnership tax basis differences for uSa Subsidiaries (37.77) (1.53) - 3.46 - - (2.33) (38.17)

defined benefit obligation 34.89 0.23 - (6.32) - - 2.06 30.86

alternative Minumum tax ('aMt') Credit (note 35) 92.80 (6.71) - - - (27.74) 5.74 64.09

others (17.36) (9.02) (0.14) (1.94) - - (0.82) (29.28)

(1,191.55) 18.54 (0.14) (37.43) - (27.74) (58.86) (1,297.18)

** Includes Impact of tax receivables (on aMt), transfer to discontinued operation, Impact of Merger of Metahelix life Sciences limited with rallis India

limited and Impact due to acquisition of non-controlling interest on ppe and Intangible assets.

(iii) Unrecognised deferred tax assets

deferred tax assets have not been recognised in respect of the following items, because it is not probable that future taxable profit

will be available against which the group can use the benefits therefrom:

` in crore

As at March 31, 2020 As at March 31, 2019

Gross Tax effect Gross Tax effect

amount amount

deductible temporary differences 1,237.11 261.23 1,304.95 248.66

unused tax losses 962.25 229.87 784.51 166.81

2,199.36 491.10 2,089.46 415.47

the tax losses amounting to ` 6.04 crore (2019: ` 257.29 crore) for which no deferred tax asset was recognised expires between FY 2020 - 2028.

the deductible temporary differences and othes unused tax losses do not expire under current tax legislation.

23. Other liabilities ` in crore

As at As at

March 31, 2020 March 31, 2019

Non-current

(a) pension payable on employee seperation 0.17 0.24

(b) deferred income (including government grants) 56.41 27.76

(c) others 41.49 40.25

98.07 68.25

Current

(a) Statutory dues 195.24 134.94

(b) advance received from customers 114.64 92.66

(c) deferred income (including government grants and emission trading allowance) 60.14 10.34

(d) others 14.40 11.85

384.42 249.79

283