Page 234 - Tata_Chemicals_yearly-reports-2019-20

P. 234

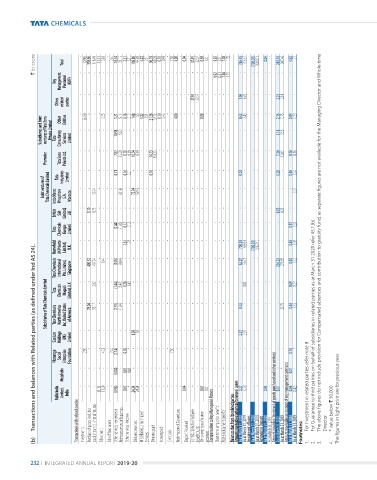

` in crore Total - - - - (0.98) 558.66 616.40 - 11.11 - - - - - - - - - - - - - - - - - - - - - - - - - - 0.69 0.01 9.92 10.51 7.38 1.75 766.45 - - 706.67 (700.03) - - (639.81) 0.04 - - - 249.70 - - 307.46 4.92 - - 1.77

2.44

16.74

21.15

15.81 -

7.50

0.40 -

0.10

2.51

2.51

96.19

169.29

5.22

3.71

109.89

94.09

4.00 -

0.04 -

37.91

32.37

Key Management Personnel (KMP) 9.92 10.51 7.38 1.75

- - - - - - - - - - - - - - - - - - - - - - - - - - 32.37 - - - - - - 1.04 6.82 - - - - 2.23 2.14 - -

Other related parties 37.91

- (3.48) - - - 0.05 - - 5.21 5.16 0.16 0.17 1.48 1.55 5.22 2.51 21.36 37.76 0.10 0.40 - - 4.00 - - - - - 0.08 - - - - - 0.42 0.45 - - - - 2.36 0.75 0.09 0.23

Entities

Subsidiaries and Joint ventures of Tata Sons Private Limited Tata Consultancy Services Limited - - - - - - - - 10.98 8.80 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 1.18 0.58 - -

Other

- - - - - - - - 7.82 12.50 0.10 0.19 10.24 8.19 - - 74.73 131.53 - - - - - - - - - - - - - - - - - - - - - - 7.30 12.05 0.18 0.16

Promoter Tata Sons Private Ltd. - - - - - - - - - - - - - - - -

Joint ventures of Tata Chemicals Limited Indo Maroc Tata Phosphore Industries S.A. Limited Morocco - - - 99.94 - - - - - 0.71 - (0.18) - - 0.16 0.01 - - - - 0.10 - - - - - - - - - - - - - - - - - 0.03 - - - - - - - 0.28 - - - 0.06 - 0.04 0.07

58.43 - - - - - - - - - - - - - - - -

72.24

British Salt Limited, U.K - - 0.10 0.73 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 0.05 0.31 - -

Chemicals Europe Limited

Tata - - - - - - - - (2.44) (1.82) 0.12 0.12 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 0.97 0.33

Homefield UK Private Limited, U.K. - - - - - - - - - - 1.61 1.78 - - - - - - - - - - - - - - - - - - - - - - 700.03 639.81 (700.03) (639.81) - - - - 0.85 0.38 The above figures do not include provision for Compensated absences and contribution to gratuity fund, as separate figures are not available for the Managing Director and Whole-time

Transactions and balances with Related parties (as defined under Ind AS 24).

0.44 - -

Tata Chemicals International Pte. Limited, Singapore - - - - - 480.52 457.94 2.62 - - - - - (0.05) (1.44) (0.04) - - - - - - - - - - - - - - - - - - - - - - - - 62.07 - 56.73 0.01 - - - - - - - - 236.29 - - 270.88 0.02 0.69 0.02 0.33

Subsidiaries of Tata Chemicals Limited Tata Tata Chemicals Chemicals North America Magadi Inc, United States Limited, U.K of America - - 78.04 55.17 - - - - (1.91) (1.84) - - - - - - - - - - - - - - - - - - - - - - - - 0.32 - - - - - - 20.75 0.63 0.63

1.43 - - - - - - - - - - - - - - - - - -

- - - -

0.26

(1.43)

- - - - - - - - - - - - 1.59 1.58 - - - - - - - - - - - - - - - - - - - - 2.27 2.07 - - For Guarantee to third parties on behalf of subsidiaries in related parties as at March 31 2020 refer 45.1.(b)

Gusiute Holdings (UK) Limited

Ncourage Social Enterprise Foundation - 2.50 - - - 4.03 - 2.44 (1.14) - 0.02 * - - - - - - - - - 7.50 - - - - - - - - - - - - - - - - - - - - 0.76 *

Metahelix - - - - - - - - (0.04) - 0.01 0.01 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - * 0.01 -

Rallis India Limited, India - - - - 11.11 11.29 - - (0.96) - 0.07 * 24.34 24.34 - - - - - - - - - - 0.04 - - - 0.61 0.01 - - - - 0.27 0.78 - - 0.04 - Amount payables ( in respect of goods purchased and other services) 0.01 - Amount receivable on account of any management contracts 0.66 (0.42) For Investment in related parties refer note 8 The figures in light print are for previous year

Transactions with related parties Purchase of goods (includes stock in transit) - (net of returns) Other services - expenses & Reimbursement of Expenses Other services - Income Miscellaneous purchases/ Redemption of Debentures Contributions to employee Other employees' related Compensation to key Managerial Person Short-term employee benefits Post-employment benefits Balances due from /to related parties Amount receivables/ad

(b) Investments Sales ( net ) Sale of fixed assets Dividend received Services Dividend paid Interest paid Grant paid Deposit Received benefit trusts expenses Footnotes: 1. 2. 3. 4.

232 I INTEGRATED ANNuAL REPORT 2019-20