Page 204 - Tata_Chemicals_yearly-reports-2019-20

P. 204

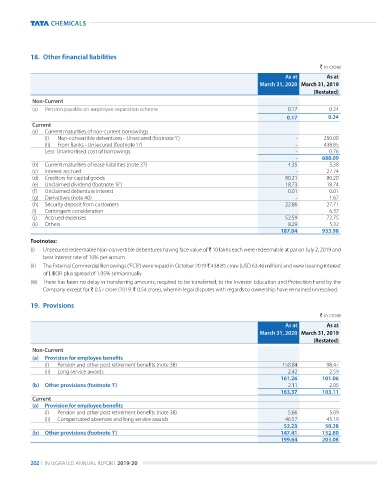

18. Other financial liabilities

` in crore

As at As at

March 31, 2020 March 31, 2019

(Restated)

Non-Current

(a) Pension payable on employee separation scheme 0.17 0.24

0.17 0.24

Current

(a) Current maturities of non-current borrowings

(i) Non-convertible debentures - unsecured (footnote 'i') - 250.00

(ii) From Banks - unsecured (footnote 'ii') - 438.85

Less: unamortised cost of borrowings - 0.76

- 688.09

(b) Current maturities of lease liabilities (note 37) 4.35 5.38

(c) Interest accrued - 27.74

(d) Creditors for capital goods 80.21 80.20

(e) unclaimed dividend (footnote 'iii') 18.73 18.74

(f) unclaimed debenture interest 0.01 0.01

(g) Derivatives (note 40) - 1.67

(h) Security deposit from customers 22.86 27.71

(i) Contingent consideration - 6.37

(j) Accrued expenses 52.59 72.75

(k) Others 8.29 5.32

187.04 933.98

Footnotes:

(i) unsecured redeemable Non-convertible debentures having face value of ` 10 lakhs each were redeemable at par on July 2, 2019 and

bear interest rate of 10% per annum.

(ii) The External Commercial Borrowings ('ECB') were repaid in October 2019 ` 438.85 crore (uSD 63.46 million) and were bearing interest

of LIBOR plus spread of 1.95% semiannually.

(iii) There has been no delay in transferring amounts, required to be transferred, to the Investor Education and Protection Fund by the

Company except for ` 0.57 crore (2019: ` 0.54 crore), wherein legal disputes with regards to ownership have remained unresolved.

19. Provisions

` in crore

As at As at

March 31, 2020 March 31, 2019

(Restated)

Non-Current

(a) Provision for employee benefits

(i) Pension and other post retirement benefits (note 38) 158.84 98.47

(ii) Long service awards 2.42 2.59

161.26 101.06

(b) Other provisions (footnote 'i') 2.11 2.05

163.37 103.11

Current

(a) Provision for employee benefits

(i) Pension and other post retirement benefits (note 38) 5.66 5.09

(ii) Compensated absences and long service awards 46.57 45.19

52.23 50.28

(b) Other provisions (footnote 'i') 147.41 152.80

199.64 203.08

202 I INTEGRATED ANNuAL REPORT 2019-20