Page 203 - Tata_Chemicals_yearly-reports-2019-20

P. 203

Integrated report Statutory reportS Financial StatementS

Standalone

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

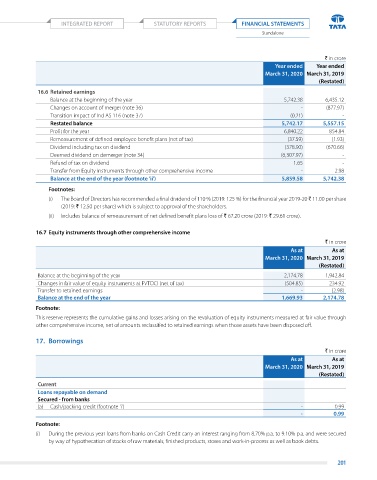

16.6 Retained earnings

Balance at the beginning of the year 5,742.38 6,435.12

Changes on account of merger (note 36) - (877.97)

Transition impact of Ind AS 116 (note 37) (0.21) -

Restated balance 5,742.17 5,557.15

Profit for the year 6,840.22 854.84

Remeasurement of defined employee benefit plans (net of tax) (37.59) (1.93)

Dividend including tax on dividend (378.90) (670.66)

Deemed dividend on demerger (note 34) (6,307.97) -

Refund of tax on dividend 1.65 -

Transfer from Equity instruments through other comprehensive income - 2.98

Balance at the end of the year (footnote 'ii') 5,859.58 5,742.38

Footnotes:

(i) The Board of Directors has recommended a final dividend of 110 % (2019: 125 %) for the financial year 2019-20 ` 11.00 per share

(2019: ` 12.50 per share) which is subject to approval of the shareholders.

(ii) Includes balance of remeasurement of net defined benefit plans loss of ` 67.20 crore (2019: ` 29.61 crore).

16.7 Equity instruments through other comprehensive income

` in crore

As at As at

March 31, 2020 March 31, 2019

(Restated)

Balance at the beginning of the year 2,174.78 1,942.84

Changes in fair value of equity instruments at FVTOCI (net of tax) (504.85) 234.92

Transfer to retained earnings - (2.98)

Balance at the end of the year 1,669.93 2,174.78

Footnote:

This reserve represents the cumulative gains and losses arising on the revaluation of equity instruments measured at fair value through

other comprehensive income, net of amounts reclassified to retained earnings when those assets have been disposed off.

17. Borrowings

` in crore

As at As at

March 31, 2020 March 31, 2019

(Restated)

Current

Loans repayable on demand

Secured - from banks

(a) Cash/packing credit (footnote 'i') - 0.99

- 0.99

Footnote:

(i) During the previous year loans from banks on Cash Credit carry an interest ranging from 8.70% p.a. to 9.10% p.a. and were secured

by way of hypothecation of stocks of raw materials, finished products, stores and work-in-process as well as book debts.

201