Page 200 - Tata_Chemicals_yearly-reports-2019-20

P. 200

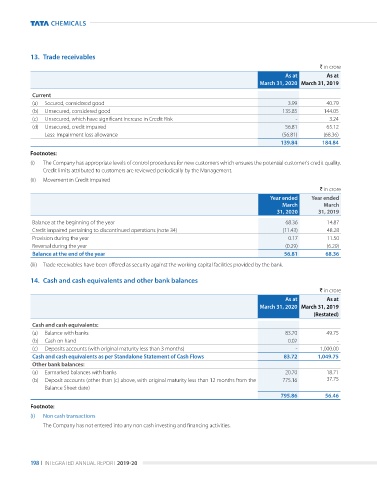

13. Trade receivables

` in crore

As at As at

March 31, 2020 March 31, 2019

Current

(a) Secured, considered good 3.99 40.79

(b) unsecured, considered good 135.85 144.05

(c) unsecured, which have significant increase in Credit Risk - 3.24

(d) unsecured, credit impaired 56.81 65.12

Less: Impairment loss allowance (56.81) (68.36)

139.84 184.84

Footnotes:

(i) The Company has appropriate levels of control procedures for new customers which ensures the potential customer's credit quality.

Credit limits attributed to customers are reviewed periodically by the Management.

(ii) Movement in Credit impaired

` in crore

Year ended Year ended

March March

31, 2020 31, 2019

Balance at the beginning of the year 68.36 14.87

Credit impaired pertaining to discontinued operations (note 34) (11.43) 48.28

Provision during the year 0.17 11.50

Reversal during the year (0.29) (6.29)

Balance at the end of the year 56.81 68.36

(iii) Trade receivables have been offered as security against the working capital facilities provided by the bank.

14. Cash and cash equivalents and other bank balances

` in crore

As at As at

March 31, 2020 March 31, 2019

(Restated)

Cash and cash equivalents:

(a) Balance with banks 83.70 49.75

(b) Cash on hand 0.02 -

(c) Deposits accounts (with original maturity less than 3 months) - 1,000.00

Cash and cash equivalents as per Standalone Statement of Cash Flows 83.72 1,049.75

Other bank balances:

(a) Earmarked balances with banks 20.70 18.71

(b) Deposit accounts (other than (c) above, with original maturity less than 12 months from the 775.16 37.75

Balance Sheet date)

795.86 56.46

Footnote:

(i) Non cash transactions

The Company has not entered into any non cash investing and financing activities.

198 I INTEGRATED ANNuAL REPORT 2019-20