Page 61 - Tata_Chemicals_yearly-reports-2020-2021

P. 61

Integrated Report Statutory Reports Financial Statements

Integrated Annual Report 2020-21 Results at Glance 60-146 147-300

Results at Glance

operational and strategic Developments

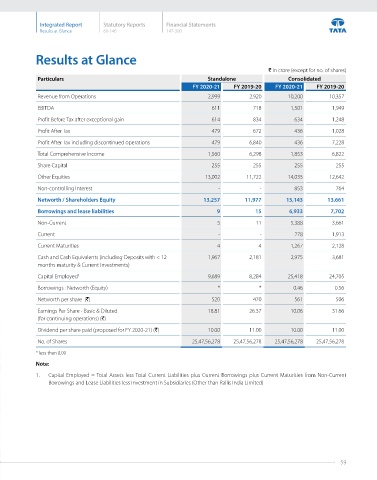

` in crore (except for no. of shares)

Ran operations successfully to serve domestic and overseas Enhanced reach in Crop Care through dealer network Particulars Standalone Consolidated

customers in timely manner and delivered stable performance realignment FY 2020-21 FY 2019-20 FY 2020-21 FY 2019-20

despite challenges backed by rejuvenated strategy, new Aligned CSR strategy and operations with Tata Chemicals Revenue from Operations 2,999 2,920 10,200 10,357

product launches and initiatives to enhance brand visibility

Society for Rural Development (TCSRD) for better impact EBITDA 611 718 1,501 1,949

Enhanced active ingredients manufacturing capacities, Progressed on sustainability commitment by launching

completed new formulation plant and progressed on water-based formulations and a range of fertigation and foliar Profit Before Tax after exceptional gain 614 834 634 1,248

construction of the multi-purpose plant

nutrition products. Profit After Tax 479 672 436 1,028

Initiated steps to accelerate innovation by investing in a new Profit After Tax including discontinued operations 479 6,840 436 7,228

integrated R&D centre, shifting to data-driven R&D and working

on cutting-edge technologies Refer to page 87 in Management, Discussion and Analysis Total Comprehensive Income 1,560 6,298 1,853 6,822

for more information on our operational performance

Share Capital 255 255 255 255

Other Equities 13,002 11,722 14,035 12,642

Way forward Non-controlling Interest - - 853 764

Capitalise on post-pandemic emerging opportunities Continue sustainability commitment by emphasising on green Networth / Shareholders Equity 13,257 11,977 15,143 13,661

by making right investments in manufacturing and R&D, and blue triangle (less toxic) products Borrowings and lease liabilities 9 15 6,933 7,702

strengthening brands and improving internal processes Continue leveraging digital technologies to convert data into

through digitalisation Non-Current 5 11 5,388 3,661

knowledge, insights and wisdom to ensure future plans and

Sustained R&D to improve performance of existing products deliver benefits to growers Current - - 278 1,913

and launch newer ones

Created a dedicated business development and research team Current Maturities 4 4 1,267 2,128

Focus on adding formulation and active ingredients to expand contract manufacturing base; plans for capacity

manufacturing plants to strengthen capabilities across expansion to meet growing demand also on anvil Cash and Cash Equivalents (including Deposits with < 12 1,967 2,181 2,975 3,681

business segments months maturity & Current Investments)

Capital Employed 1 9,689 8,284 25,418 24,705

Borrowings : Networth (Equity) * * 0.46 0.56

Networth per share (`) 520 470 561 506

Earnings Per Share - Basic & Diluted 18.81 26.37 10.06 31.66

(for continuing operations) (`)

Dividend per share paid (proposed for FY 2020-21) (`) 10.00 11.00 10.00 11.00

No. of Shares 25,47,56,278 25,47,56,278 25,47,56,278 25,47,56,278

* less than 0.00

Note:

1. Capital Employed = Total Assets less Total Current Liabilities plus Current Borrowings plus Current Maturities from Non-Current

Borrowings and Lease Liabilities less Investment in Subsidiaries (Other than Rallis India Limited)

58 59