Page 76 - Tata_Chemicals_yearly-reports-2019-20

P. 76

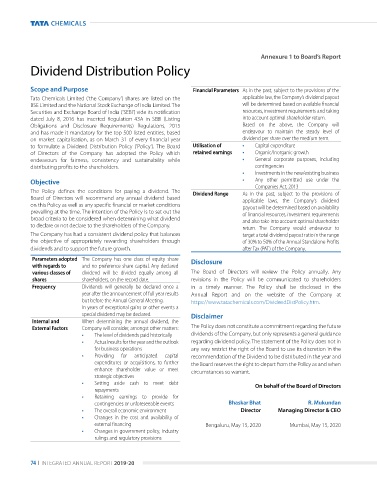

Annexure 1 to Board’s Report

Dividend Distribution Policy

Scope and Purpose Financial Parameters as in the past, subject to the provisions of the

tata Chemicals limited (‘the Company’) shares are listed on the applicable law, the Company’s dividend payout

BSe limited and the national Stock exchange of India limited. the will be determined based on available financial

Securities and exchange Board of India (‘SeBI’) vide its notification resources, investment requirements and taking

dated July 8, 2016 has inserted regulation 43a in SeBI (listing into account optimal shareholder return.

obligations and disclosure requirements) regulations, 2015 Based on the above, the Company will

and has made it mandatory for the top 500 listed entities, based endeavour to maintain the steady level of

on market capitalisation, as on March 31 of every financial year dividend per share over the medium term.

to formulate a dividend distribution policy (‘policy’). the Board Utilisation of • Capital expenditure

of directors of the Company has adopted the policy which retained earnings • organic/Inorganic growth

endeavours for fairness, consistency and sustainability while • general corporate purposes, including

distributing profits to the shareholders. contingencies

• Investments in the new/existing business

Objective • any other permitted use under the

Companies act, 2013

the policy defines the conditions for paying a dividend. the Dividend Range as in the past, subject to the provisions of

Board of directors will recommend any annual dividend based applicable laws, the Company’s dividend

on this policy as well as any specific financial or market conditions payout will be determined based on availability

prevailing at the time. the intention of the policy is to set out the of financial resources, investment requirements

broad criteria to be considered when determining what dividend and also take into account optimal shareholder

to declare or not declare to the shareholders of the Company. return. the Company would endeavour to

the Company has had a consistent dividend policy that balances target a total dividend payout ratio in the range

the objective of appropriately rewarding shareholders through of 30% to 50% of the annual Standalone profits

dividends and to support the future growth. after tax (pat) of the Company.

Parameters adopted the Company has one class of equity share Disclosure

with regards to and no preference share capital. any declared

various classes of dividend will be divided equally among all the Board of directors will review the policy annually. any

shares shareholders, on the record date. revisions in the policy will be communicated to shareholders

Frequency dividends will generally be declared once a in a timely manner. the policy shall be disclosed in the

year after the announcement of full year results annual report and on the website of the Company at

but before the annual general Meeting. https://www.tatachemicals.com/dividenddistpolicy.htm.

In years of exceptional gains or other events a

special dividend may be declared. Disclaimer

Internal and When determining the annual dividend, the

External Factors Company will consider, amongst other matters: the policy does not constitute a commitment regarding the future

• the level of dividends paid historically dividends of the Company, but only represents a general guidance

• actual results for the year and the outlook regarding dividend policy. the statement of the policy does not in

for business operations any way restrict the right of the Board to use its discretion in the

• providing for anticipated capital recommendation of the dividend to be distributed in the year and

expenditures or acquisitions, to further the Board reserves the right to depart from the policy as and when

enhance shareholder value or meet circumstances so warrant.

strategic objectives

• Setting aside cash to meet debt On behalf of the Board of Directors

repayments

• retaining earnings to provide for

contingencies or unforeseeable events Bhaskar Bhat R. Mukundan

• the overall economic environment Director Managing Director & CEO

• Changes in the cost and availability of

external financing Bengaluru, May 15, 2020 Mumbai, May 15, 2020

• Changes in government policy, industry

rulings and regulatory provisions

74 I Integrated annual report 2019-20