Page 306 - Tata_Chemicals_yearly-reports-2019-20

P. 306

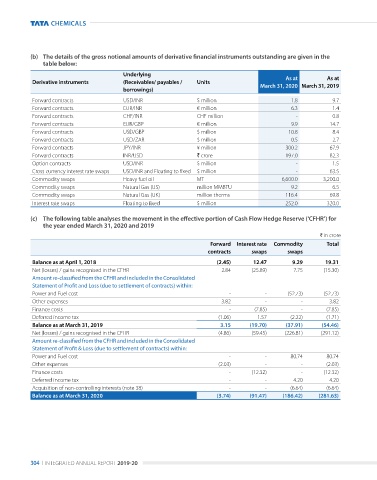

(b) The details of the gross notional amounts of derivative financial instruments outstanding are given in the

table below:

Underlying

As at

As at

Derivative instruments (Receivables/ payables / Units March 31, 2020 March 31, 2019

borrowings)

Forward contracts uSd/Inr $ million 1.8 9.7

Forward contracts eur/Inr € million 6.3 1.4

Forward contracts CHF/Inr CHF million - 0.8

Forward contracts eur/gBp € million 9.9 14.7

Forward contracts uSd/gBp $ million 10.8 8.4

Forward contracts uSd/Zar $ million 0.5 2.7

Forward contracts JpY/Inr ¥ million 300.2 67.9

Forward contracts Inr/uSd ` crore 197.0 82.3

option contracts uSd/Inr $ million - 1.5

Cross currency interest rate swaps uSd/Inr and Floating to fixed $ million - 63.5

Commodity swaps Heavy fuel oil Mt 6,600.0 3,200.0

Commodity swaps natural gas (uS) million MMBtu 9.2 6.5

Commodity swaps natural gas (uK) million therms 116.4 69.8

Interest rate swaps Floating to fixed $ million 252.0 320.0

(c) The following table analyses the movement in the effective portion of Cash Flow Hedge Reserve (‘CFHR’) for

the year ended March 31, 2020 and 2019

` in crore

Forward Interest rate Commodity Total

contracts swaps swaps

Balance as at April 1, 2018 (2.45) 12.47 9.29 19.31

net (losses) / gains recognised in the CFHr 2.84 (25.89) 7.75 (15.30)

Amount re-classified from the CFHR and included in the Consolidated

Statement of Profit and Loss (due to settlement of contracts) within:

power and Fuel cost - - (52.73) (52.73)

other expenses 3.82 - - 3.82

Finance costs - (7.85) - (7.85)

deferred income tax (1.06) 1.57 (2.22) (1.71)

Balance as at March 31, 2019 3.15 (19.70) (37.91) (54.46)

net (losses) / gains recognised in the CFHr (4.86) (59.45) (226.81) (291.12)

Amount re-classified from the CFHR and included in the Consolidated

Statement of Profit & Loss (due to settlement of contracts) within:

power and Fuel cost - - 80.74 80.74

other expenses (2.03) - - (2.03)

Finance costs - (12.32) - (12.32)

deferred income tax - - 4.20 4.20

acquisition of non-controlling interests (note 38) - - (6.64) (6.64)

Balance as at March 31, 2020 (3.74) (91.47) (186.42) (281.63)

304 I Integrated annual report 2019-20