Page 226 - Tata_Chemicals_yearly-reports-2019-20

P. 226

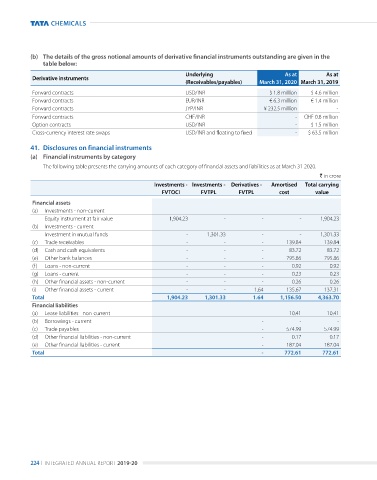

(b) The details of the gross notional amounts of derivative financial instruments outstanding are given in the

table below:

Underlying As at As at

Derivative instruments

(Receivables/payables) March 31, 2020 March 31, 2019

Forward contracts uSD/INR $ 1.8 million $ 4.6 million

Forward contracts EuR/INR € 6.3 million € 1.4 million

Forward contracts JYP/INR ¥ 232.5 million -

Forward contracts CHF/INR - CHF 0.8 million

Option contracts uSD/INR - $ 1.5 million

Cross-currency interest rate swaps uSD/INR and floating to fixed - $ 63.5 million

41. Disclosures on financial instruments

(a) Financial instruments by category

The following table presents the carrying amounts of each category of financial assets and liabilities as at March 31 2020.

` in crore

Investments - Investments - Derivatives - Amortised Total carrying

FVTOCI FVTPL FVTPL cost value

Financial assets

(a) Investments - non-current

Equity instrument at fair value 1,904.23 - - - 1,904.23

(b) Investments - current

Investment in mutual funds - 1,301.33 - - 1,301.33

(c) Trade receivables - - - 139.84 139.84

(d) Cash and cash equivalents - - - 83.72 83.72

(e) Other bank balances - - - 795.86 795.86

(f) Loans - non-current - - - 0.92 0.92

(g) Loans - current - - - 0.23 0.23

(h) Other financial assets - non-current - - - 0.26 0.26

(i) Other financial assets - current - - 1.64 135.67 137.31

Total 1,904.23 1,301.33 1.64 1,156.50 4,363.70

Financial liabilities

(a) Lease liabilities - non-current - 10.41 10.41

(b) Borrowings - current - - -

(c) Trade payables - 574.99 574.99

(d) Other financial liabilities - non-current - 0.17 0.17

(e) Other financial liabilities - current - 187.04 187.04

Total - 772.61 772.61

224 I INTEGRATED ANNuAL REPORT 2019-20