Page 225 - Tata_Chemicals_yearly-reports-2019-20

P. 225

Integrated report Statutory reportS Financial StatementS

Standalone

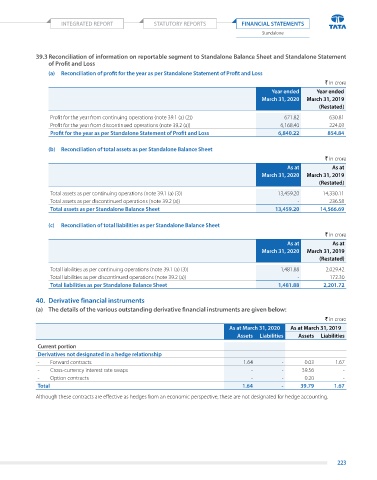

39.3 Reconciliation of information on reportable segment to Standalone Balance Sheet and Standalone Statement

of Profit and Loss

(a) Reconciliation of profit for the year as per Standalone Statement of Profit and Loss

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

Profit for the year from continuing operations (note 39.1 (a) (2)) 671.82 630.81

Profit for the year from discontinued operations (note 39.2 (a)) 6,168.40 224.03

Profit for the year as per Standalone Statement of Profit and Loss 6,840.22 854.84

(b) Reconciliation of total assets as per Standalone Balance Sheet

` in crore

As at As at

March 31, 2020 March 31, 2019

(Restated)

Total assets as per continuing operations (note 39.1 (a) (3)) 13,459.20 14,330.11

Total assets as per discontinued operations (note 39.2 (a)) - 236.58

Total assets as per Standalone Balance Sheet 13,459.20 14,566.69

(c) Reconciliation of total liabilities as per Standalone Balance Sheet

` in crore

As at As at

March 31, 2020 March 31, 2019

(Restated)

Total liabilities as per continuing operations (note 39.1 (a) (3)) 1,481.88 2,029.42

Total liabilities as per discontinued operations (note 39.2 (a)) - 172.30

Total liabilities as per Standalone Balance Sheet 1,481.88 2,201.72

40. Derivative financial instruments

(a) The details of the various outstanding derivative financial instruments are given below:

` in crore

As at March 31, 2020 As at March 31, 2019

Assets Liabilities Assets Liabilities

Current portion

Derivatives not designated in a hedge relationship

- Forward contracts 1.64 - 0.03 1.67

- Cross-currency interest rate swaps - - 39.56 -

- Option contracts - - 0.20 -

Total 1.64 - 39.79 1.67

Although these contracts are effective as hedges from an economic perspective, these are not designated for hedge accounting.

223