Page 179 - Tata_Chemicals_yearly-reports-2019-20

P. 179

Integrated report Statutory reportS Financial StatementS

Standalone

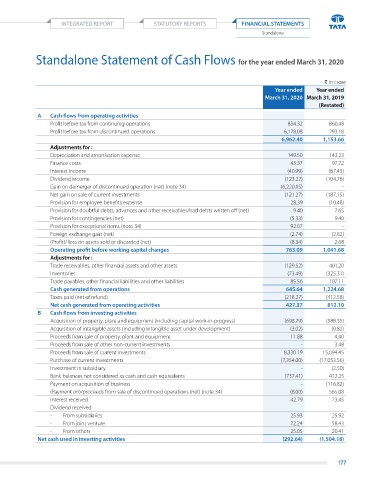

Standalone Statement of Cash Flows for the year ended March 31, 2020

` in crore

Year ended Year ended

March 31, 2020 March 31, 2019

(Restated)

A Cash flows from operating activities

Profit before tax from continuing operations 834.32 860.48

Profit before tax from discontinued operations 6,128.08 293.18

6,962.40 1,153.66

Adjustments for :

Depreciation and amortisation expense 149.50 143.23

Finance costs 43.37 97.72

Interest income (40.99) (67.45)

Dividend income (123.22) (104.76)

Gain on demerger of discontinued operation (net) (note 34) (6,220.15) -

Net gain on sale of current investments (121.27) (187.15)

Provision for employee benefits expense 28.39 (10.48)

Provision for doubtful debts, advances and other receivables/bad debts written off (net) 9.40 7.65

Provision for contingencies (net) (5.33) 9.40

Provision for exceptional items (note 34) 92.07 -

Foreign exchange gain (net) (2.74) (2.82)

(Profit)/ loss on assets sold or discarded (net) (8.34) 2.68

Operating profit before working capital changes 763.09 1,041.68

Adjustments for :

Trade receivables, other financial assets and other assets (129.52) 401.20

Inventories (73.49) (325.31)

Trade payables, other financial liabilities and other liabilities 85.56 107.11

Cash generated from operations 645.64 1,224.68

Taxes paid (net of refund) (218.27) (412.58)

Net cash generated from operating activities 427.37 812.10

B Cash flows from investing activities

Acquisition of property, plant and equipment (including capital work-in-progress) (698.29) (588.35)

Acquisition of intangible assets (including intangible asset under development) (3.02) (0.82)

Proceeds from sale of property, plant and equipment 11.88 4.40

Proceeds from sale of other non-current investments - 3.48

Proceeds from sale of current investments 8,330.19 15,094.45

Purchase of current investments (7,354.00) (17,053.56)

Investment in subsidiary - (2.50)

Bank balances not considered as cash and cash equivalents (737.41) 412.25

Payment on acquisition of business - (116.82)

(Payment on)/proceeds from sale of discontinued operations (net) (note 34) (8.00) 565.08

Interest received 42.79 73.45

Dividend received

- From subsidiaries 25.93 25.92

- From joint venture 72.24 58.43

- From others 25.05 20.41

Net cash used in investing activities (292.64) (1,504.18)

177