Page 281 - Tata Chemical Annual Report_2022-2023

P. 281

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

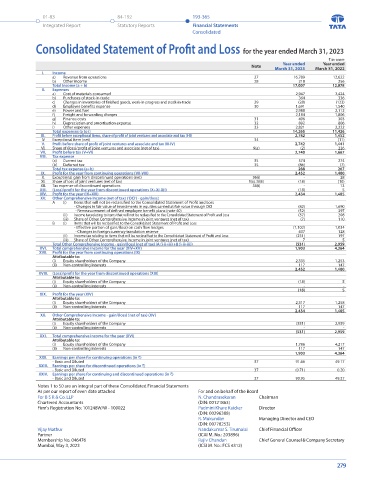

Consolidated Balance Sheet as at March 31, 2023 Consolidated Statement of Profit and Loss for the year ended March 31, 2023

` in crore ` in crore

As at As at Note Year ended Year ended

Note March 31, 2023 March 31, 2022

March 31, 2023 March 31, 2022 I. Income

I. ASSETS a) Revenue from operations 27 16,789 12,622

(1) Non-current assets b) Other income 28 218 256

(a) Property, plant and equipment 4(a) 6,367 5,985 Total Income (a + b) 17,007 12,878

(b) Capital work-in-progress 4(b) 2,351 1,590 II. Expenses 2,947 2,424

a)

Cost of materials consumed

(c) Investment property 5 52 54 b) Purchases of stock-in-trade 364 336

(d) Right-of-use assets 6 202 215 c) Changes in inventories of finished goods, work-in-progress and stock-in-trade 29 (28) (123)

(e) Goodwill on consolidation 7(a) 2,109 1,971 d) Employee benefits expense 30 1,691 1,540

(f) Goodwill 7(b) 46 46 e) Power and fuel 2,988 2,112

(g) Other intangible assets 8(a) 8,316 7,773 f) Freight and forwarding charges 2,184 1,806

(h) Intangible assets under development 8(b) 59 78 g) Finance costs 31 406 303

(i) Investments in joint ventures and associate 9(a), 9(b) 1,136 1,234 h) Depreciation and amortisation expense 32 892 806

2,821

2,222

(j) Financial assets i) Other expenses 33 14,265 11,426

Total expenses (a to i)

(i) Other investments 9(c) 5,042 5,124 III. Profit before exceptional items, share of profit of joint ventures and associate and tax (I-II) 2,742 1,452

(ii) Other financial assets 11 40 54 IV Exceptional item (net) 34 - (11)

(k) Deferred tax assets (net) 22 144 - V. Profit before share of profit of joint ventures and associate and tax (III-IV) 2,742 1,441

(l) Advance tax assets (net) 24(a) 767 707 VI. Share of (loss)/profit of joint ventures and associate (net of tax) 9(a) (2) 226

(m) Other non-current assets 12 289 267 VII. Profit before tax (V+VI) 2,740 1,667

Total non-current assets 26,920 25,098 VIII. Tax expense

(2) Current assets (a) Current tax 35 374 274

(a) Inventories 13 2,532 2,294 (b) Deferred tax 35 (86) (7)

288

267

(b) Financial assets IX. Total tax expense (a+b) 2,452 1,400

Profit for the year from continuing operations (VII-VIII)

(i) Investments 9(d) 1,270 1,325 X. Exceptional gain from discontinued operations (net) 36(i) - 28

(ii) Trade receivables 14 2,627 1,933 XI. Share of loss of joint ventures (net of tax) 9(a), 36(ii) (18) (10)

(iii) Cash and cash equivalents 15 508 762 XII. Tax expense of discontinued operations 36(i) - 13

(iv) Bank balances other than (iii) above 15 157 549 XIII. (Loss)/profit for the year from discontinued operations (X+XI-XII) (18) 5

(v) Loans 10 325 - XIV. Profit for the year (IX+XIII) 2,434 1,405

(vi) Other financial assets 11 61 1,175 XV. Other Comprehensive Income (net of tax) ('OCI') - gain/(loss)

(c) Current tax assets (net) 24(a) - 1 A (i) Items that will not be reclassified to the Consolidated Statement of Profit and Loss

(d) Other current assets 12 680 702 - Changes in fair value of investments in equities carried at fair value through OCI (82) 1,690

(52)

- Remeasurement of defined employee benefit plans (note 40)

397

8,160 8,741 (ii) Income tax relating to items that will not be reclassified to the Consolidated Statement of Profit and Loss (37) 208

Assets classified as held for sale 26(a) 4 4 (iii) Share of Other Comprehensive Income in joint ventures (net of tax) (7) 110

Total current assets 8,164 8,745 B (i) Items that will be reclassified to the Consolidated Statement of Profit and Loss

Total assets 35,084 33,843 - Effective portion of gain/(loss) on cash flow hedges (1,102) 1,034

II. EQUITY AND LIABILITIES - Changes in foreign currency translation reserve 437 128

Equity (ii) Income tax relating to items that will be reclassified to the Consolidated Statement of Profit and Loss (231) 197

(a) Equity share capital 16 255 255 (iii) Share of Other Comprehensive Income in joint ventures (net of tax) 7 5

(b) Other equity 17 19,466 17,998 Total Other Comprehensive Income - gain/(loss) (net of tax) (A (i-ii+iii) +B (i-ii+iii)) (531) 2,959

XVI.

Equity attributable to equity share holders 19,721 18,253 XVII. Total comprehensive income for the year (XIV+XV) 1,903 4,364

Profit for the year from continuing operations (IX)

Non-controlling interests 18 921 904 Attributable to:

Total equity 20,642 19,157 (i) Equity shareholders of the Company 2,335 1,253

Liabilities (ii) Non-controlling interests 117 147

(1) Non-current liabilities 2,452 1,400

(a) Financial liabilities XVIII. (Loss)/profit for the year from discontinued operations (XIII)

(i) Borrowings 19 5,540 3,725 Attributable to:

(ii) Lease liabilities 39 137 135 (i) Equity shareholders of the Company (18) 5

(iii) Other financial liabilities 20 48 16 (ii) Non-controlling interests - -

(b) Provisions 21 1,454 1,280 XIX. Profit for the year (XIV) (18) 5

(c) Deferred tax liabilities (net) 22 1,935 2,037 Attributable to:

(d) Other non-current liabilities 23 424 397 (i) Equity shareholders of the Company 2,317 1,258

Total non-current liabilities 9,538 7,590 (ii) Non-controlling interests 117 147

(2) Current liabilities 2,434 1,405

(a) Financial liabilities XX. Other Comprehensive Income - gain/(loss) (net of tax) (XV)

(i) Borrowings 19 543 3,077 Attributable to:

(ii) Lease liabilities 39 76 87 (i) Equity shareholders of the Company (531) 2,959

(iii) Trade payables (ii) Non-controlling interests (531) - 2,959 -

- Outstanding dues of micro enterprises and small enterprises 25 21 20 XXI. Total comprehensive income for the year (XVI)

- Outstanding dues of creditors other than above 25 2,576 2,425 Attributable to:

(iv) Other financial liabilities 20 696 458 (i) Equity shareholders of the Company 1,786 4,217

(b) Other current liabilities 23 521 536 (ii) Non-controlling interests 117 147

(c) Provisions 21 352 371 1,903 4,364

(d) Current tax liabilities (net) 24(b) 119 122 XXII. Earnings per share for continuing operations (in `)

Total current liabilities 4,904 7,096 - Basic and Diluted 37 91.66 49.17

Total liabilities 14,442 14,686 XXIII. Earnings per share for discontinued operations (in `)

Total equity and liabilities 35,084 33,843 - Basic and Diluted 37 (0.71) 0.20

XXIV. Earnings per share for continuing and discontinued operations (in `)

Notes 1 to 50 are an integral part of these Consolidated Financial Statements - Basic and Diluted 37 90.95 49.37

As per our report of even date attached For and on behalf of the Board Notes 1 to 50 are an integral part of these Consolidated Financial Statements

For B S R & Co. LLP N. Chandrasekaran Chairman As per our report of even date attached For and on behalf of the Board

Chartered Accountants (DIN: 00121863) For B S R & Co. LLP N. Chandrasekaran Chairman

Firm's Registration No: 101248W/W - 100022 Padmini Khare Kaicker Director Chartered Accountants (DIN: 00121863)

(DIN: 00296388) Firm's Registration No: 101248W/W - 100022 Padmini Khare Kaicker Director

R. Mukundan Managing Director and CEO (DIN: 00296388)

(DIN: 00778253) R. Mukundan Managing Director and CEO

Vijay Mathur Nandakumar S. Tirumalai Chief Financial Officer (DIN: 00778253)

Partner (ICAI M. No.: 203896) Vijay Mathur Nandakumar S. Tirumalai Chief Financial Officer

Partner

(ICAI M. No.: 203896)

Membership No. 046476 Rajiv Chandan Chief General Counsel & Company Secretary Membership No. 046476 Rajiv Chandan Chief General Counsel & Company Secretary

Mumbai, May 3, 2023 (ICSI M. No.: FCS 4312) Mumbai, May 3, 2023 (ICSI M. No.: FCS 4312)

278 279