Page 210 - Tata Chemical Annual Report_2022-2023

P. 210

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

` in crore 255 255 ` in crore Total 13,002 802 - 1,538 2,340 (255) - 15,087 1,027 - (59) 968 (318) - 15,737 Standalone Statement of Cash Flows for the year ended March 31, 2023

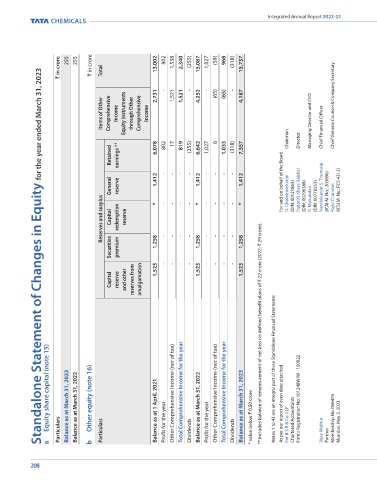

Standalone Statement of Changes in Equity for the year ended March 31, 2023

` in crore

Year ended

Year ended

Particulars

March 31, 2023

March 31, 2022

Items of Other Comprehensive Income Equity instruments through Other Comprehensive Income 2,731 1,521 1,521 4,252 (65) (65) 4,187 Managing Director and CEO Chief Financial Officer Chief General Counsel & Company Secretary A Cash flows from operating activities 1,265 1,016

988

Profit before tax from continuing operations

1,265

-

28

Profit before tax from discontinued operations

Adjustments for :

222

245

19

Finance costs

26

Retained earnings ** 6,078 802 17 819 (255) 6,642 1,027 6 1,033 (318) 7,357 Chairman Director Depreciation and amortisation expense (162) (110)

Interest income

(61)

Dividend income

(83)

General reserve 1,412 - - - - 1,412 - - - - 1,412 For and on behalf of the Board N. Chandrasekaran (DIN: 00121863) Padmini Khare Kaicker (DIN: 00296388) R. Mukundan (DIN: 00778253) Nandakumar S. Tirumalai (ICAI M. No.: 203896) Rajiv Chandan (ICSI M. No.: FCS 4312) Net gain on sale of current investments (54) (46)

8

21

Provision for employee benefits expense

Provision for doubtful debts and advances/bad debts written off (net)

(1)

1

23

Provision for contingencies (net)

14

Reserves and surplus Capital redemption reserve * - - - - * - - - - * Liabilities no longer required written back 1,309 1,038

(2)

(1)

(5)

Foreign exchange (gain)/loss (net)

3

5

4

Loss on assets sold or discarded (net)

** Includes balance of remeasurement of net loss on defined benefit plans of ` 22 crore (2022: ` 29 crore).

Operating profit before working capital changes

Securities premium 1,258 - - - - 1,258 - - - - 1,258 Adjustments for : (324) (358)

Trade receivables, other financial assets and other assets

40

20

Inventories

141

67

Capital reserve and other reserves from amalgamation 1,523 - - - - 1,523 - - - - 1,523 Trade payables, other financial liabilities and other liabilities 1,166 (185)

Cash generated from operations

767

Taxes paid (net of refund)

(281)

Cash flows from investing activities

B Net cash generated from operating activities 885 582

Acquisition of property, plant and equipment (including capital work-in-progress) (946) (776)

Acquisition of intangible assets (including intangible asset under development) (1) (8)

Proceeds from sale of property, plant and equipment 1 7

Proceeds from sale of other non-current investments (3,349) (4,229)

150

75

4,444

Proceeds from sale of current investments

3,506

Equity share capital (note 15) Balance as at March 31, 2023 Balance as at March 31, 2022 Other equity (note 16) Balance as at 1 April, 2021 Other Comprehensive Income (net of tax) Total Comprehensive Income for the year Balance as at March 31, 2022 Other Comprehensive Income (net of tax) Total Comprehensive Income for the year Balance as at March 31, 2023 Notes 1 to 43 are an integral part of these Standalone Financial Statements As per our r

(150)

Purchase of non-current investments

(133)

Purchase of current investments

-

(39)

402

Bank balances not considered as cash and cash equivalents (net)

-

Loans - Inter-corporate deposit placed

34

31

Interest received

Dividend received

29

29

From subsidiaries

-

92

28

From others

-

26

41

Net cash used in investing activities

a Particulars b Particulars Profit for the year Dividends Profit for the year Dividends * value below ` 0.50 crore For B S R & Co. LLP Chartered Accountants Vijay Mathur Partner Membership No. 046476 Mumbai, May 3, 2023 - From joint venture (558) (355)

208 209