Page 242 - Tata_Chemicals_yearly-reports-2021-22

P. 242

Integrated Annual Report 2021-22

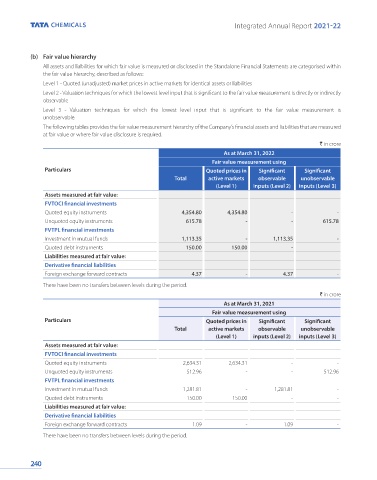

(b) Fair value hierarchy

All assets and liabilities for which fair value is measured or disclosed in the Standalone Financial Statements are categorised within

the fair value hierarchy, described as follows:

Level 1 - Quoted (unadjusted) market prices in active markets for identical assets or liabilities

Level 2 - Valuation techniques for which the lowest level input that is significant to the fair value measurement is directly or indirectly

observable

Level 3 - Valuation techniques for which the lowest level input that is significant to the fair value measurement is

unobservable.

The following tables provides the fair value measurement hierarchy of the Company’s financial assets and liabilities that are measured

at fair value or where fair value disclosure is required.

` in crore

As at March 31, 2022

Fair value measurement using

Particulars Quoted prices in Significant Significant

Total active markets observable unobservable

(Level 1) inputs (Level 2) inputs (Level 3)

Assets measured at fair value:

FVTOCI financial investments

Quoted equity instruments 4,354.80 4,354.80 - -

Unquoted equity instruments 615.78 - - 615.78

FVTPL financial investments

Investment in mutual funds 1,113.35 - 1,113.35 -

Quoted debt instruments 150.00 150.00 -

Liabilities measured at fair value:

Derivative financial liabilities

Foreign exchange forward contracts 4.37 - 4.37 -

There have been no transfers between levels during the period.

` in crore

As at March 31, 2021

Fair value measurement using

Particulars Quoted prices in Significant Significant

Total active markets observable unobservable

(Level 1) inputs (Level 2) inputs (Level 3)

Assets measured at fair value:

FVTOCI financial investments

Quoted equity instruments 2,634.31 2,634.31 - -

Unquoted equity instruments 512.96 - - 512.96

FVTPL financial investments

Investment in mutual funds 1,281.81 - 1,281.81 -

Quoted debt instruments 150.00 150.00 - -

Liabilities measured at fair value:

Derivative financial liabilities

Foreign exchange forward contracts 1.09 - 1.09 -

There have been no transfers between levels during the period.

240