Page 189 - Tata_Chemicals_yearly-reports-2021-22

P. 189

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

REPORTS

REPORT

STATEMENTS

Standalone

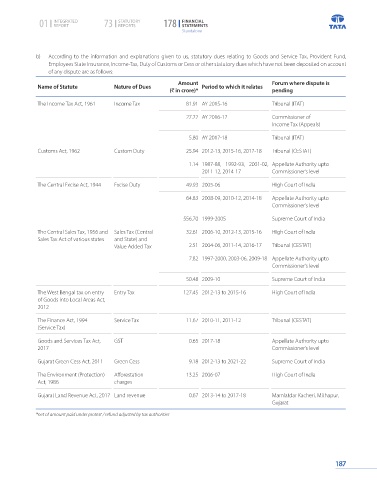

b) According to the information and explanations given to us, statutory dues relating to Goods and Service Tax, Provident Fund,

Employees State Insurance, Income-Tax, Duty of Customs or Cess or other statutory dues which have not been deposited on account

of any dispute are as follows:

Amount Forum where dispute is

Name of Statute Nature of Dues Period to which it relates

(` in crore)* pending

The Income Tax Act, 1961 Income Tax 81.91 AY 2015-16 Tribunal (ITAT)

27.72 AY 2016-17 Commissioner of

Income Tax (Appeals)

5.80 AY 2017-18 Tribunal (ITAT)

Customs Act, 1962 Custom Duty 25.94 2012-13, 2015-16, 2017-18 Tribunal (CESTAT)

1.14 1987-88, 1992-93, 2001-02, Appellate Authority upto

2011-12, 2014-17 Commissioner’s level

The Central Excise Act, 1944 Excise Duty 49.93 2005-06 High Court of India

64.83 2008-09, 2010-12, 2014-18 Appellate Authority upto

Commissioner’s level

556.70 1999-2005 Supreme Court of India

The Central Sales Tax, 1956 and Sales Tax (Central 32.61 2006-10, 2012-13, 2015-16 High Court of India

Sales Tax Act of various states and State) and

Value Added Tax 2.51 2004-06, 2011-14, 2016-17 Tribunal (CESTAT)

7.82 1997-2000, 2003-06, 2009-18 Appellate Authority upto

Commissioner’s level

50.48 2009-10 Supreme Court of India

The West Bengal tax on entry Entry Tax 127.45 2012-13 to 2015-16 High Court of India

of Goods into Local Areas Act,

2012

The Finance Act, 1994 Service Tax 11.67 2010-11, 2011-12 Tribunal (CESTAT)

(Service Tax)

Goods and Services Tax Act, GST 0.65 2017-18 Appellate Authority upto

2017 Commissioner’s level

Gujarat Green Cess Act, 2011 Green Cess 9.18 2012-13 to 2021-22 Supreme Court of India

The Environment (Protection) Afforestation 13.25 2006-07 High Court of India

Act, 1986 charges

Gujarat Land Revenue Act, 2017 Land revenue 0.67 2013-14 to 2017-18 Mamlatdar Kacheri, Mithapur,

Gujarat

*net of amount paid under protest / refund adjusted by tax authorities

187