Page 293 - Tata_Chemicals_yearly-reports-2020-2021

P. 293

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Consolidated

The Group’s policy is generally to undertake non-current borrowings using facilities that carry floating-interest rate. The Group

manages its interest rate risk by entering into interest rate swaps, in which it agrees to exchange, at specified intervals, the difference

between fixed and variable rate interest amounts calculated by reference to an agreed-upon notional principal amount.

Moreover, the short-term borrowings of the Group do not have a significant fair value or cash flow interest rate risk due to their short

tenure.

As the Group does not have exposure to any floating-interest bearing assets, or any significant long-term fixed-interest bearing

assets, its interest income and related cash inflows are not affected by changes in market interest rates.

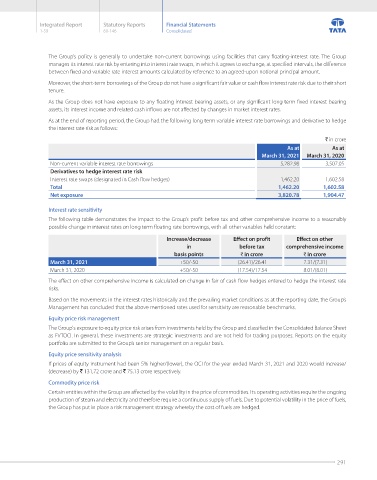

As at the end of reporting period, the Group had the following long term variable interest rate borrowings and derivative to hedge

the interest rate risk as follows:

` in crore

As at As at

March 31, 2021 March 31, 2020

Non-current variable interest rate borrowings 5,282.98 3,507.05

Derivatives to hedge interest rate risk

Interest rate swaps (designated in Cash flow hedges) 1,462.20 1,602.58

Total 1,462.20 1,602.58

Net exposure 3,820.78 1,904.47

Interest rate sensitivity

The following table demonstrates the impact to the Group’s profit before tax and other comprehensive income to a reasonably

possible change in interest rates on long term floating rate borrowings, with all other variables held constant:

Increase/decrease Effect on profit Effect on other

in before tax comprehensive income

basis points ` in crore ` in crore

March 31, 2021 +50/-50 (26.41)/26.41 7.31/(7.31)

March 31, 2020 +50/-50 (17.54)/17.54 8.01/(8.01)

The effect on other comprehensive income is calculated on change in fair of cash flow hedges entered to hedge the interest rate

risks.

Based on the movements in the interest rates historically and the prevailing market conditions as at the reporting date, the Group’s

Management has concluded that the above mentioned rates used for sensitivity are reasonable benchmarks.

Equity price risk management

The Group's exposure to equity price risk arises from investments held by the Group and classified in the Consolidated Balance Sheet

as FVTOCI. In general, these investments are strategic investments and are not held for trading purposes. Reports on the equity

portfolio are submitted to the Group’s senior management on a regular basis.

Equity price sensitivity analysis

If prices of equity instrument had been 5% higher/(lower), the OCI for the year ended March 31, 2021 and 2020 would increase/

(decrease) by ` 131,72 crore and ` 75.13 crore respectively.

Commodity price risk

Certain entities within the Group are affected by the volatility in the price of commodities. Its operating activities require the ongoing

production of steam and electricity and therefore require a continuous supply of fuels. Due to potential volatility in the price of fuels,

the Group has put in place a risk management strategy whereby the cost of fuels are hedged.

291