Page 183 - Tata_Chemicals_yearly-reports-2020-2021

P. 183

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Standalone

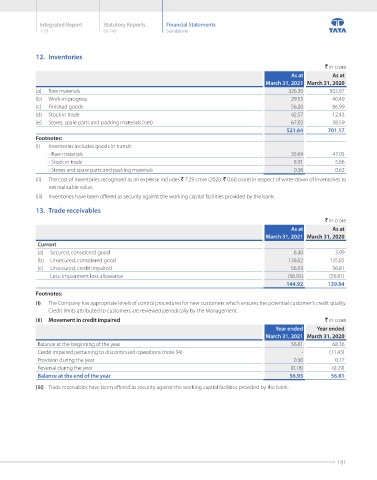

12. Inventories

` in crore

As at As at

March 31, 2021 March 31, 2020

(a) Raw materials 326.30 502.67

(b) Work-in-progress 29.55 40.49

(c) Finished goods 56.20 86.99

(d) Stock in trade 42.57 12.43

(e) Stores, spare parts and packing materials (net) 67.02 58.59

521.64 701.17

Footnotes:

(i) Inventories includes goods in transit:

- Raw materials 35.69 47.05

- Stock in trade 8.91 5.66

- Stores and spare parts and packing materials 0.36 0.62

(ii) The cost of inventories recognised as an expense includes ` 7.29 crore (2020: ` 0.60 crore) in respect of write-down of inventories to

net realisable value.

(iii) Inventories have been offered as security against the working capital facilities provided by the bank.

13. Trade receivables

` in crore

As at As at

March 31, 2021 March 31, 2020

Current

(a) Secured, considered good 6.30 3.99

(b) Unsecured, considered good 138.62 135.85

(c) Unsecured, credit impaired 56.93 56.81

Less: Impairment loss allowance (56.93) (56.81)

144.92 139.84

Footnotes:

(i) The Company has appropriate levels of control procedures for new customers which ensures the potential customer's credit quality.

Credit limits attributed to customers are reviewed periodically by the Management.

(ii) Movement in credit impaired ` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

Balance at the beginning of the year 56.81 68.36

Credit impaired pertaining to discontinued operations (note 34) - (11.43)

Provision during the year 0.30 0.17

Reversal during the year (0.18) (0.29)

Balance at the end of the year 56.93 56.81

(iii) Trade receivables have been offered as security against the working capital facilities provided by the bank.

181