Page 156 - Tata_Chemicals_yearly-reports-2020-2021

P. 156

Integrated Annual Report 2020-21

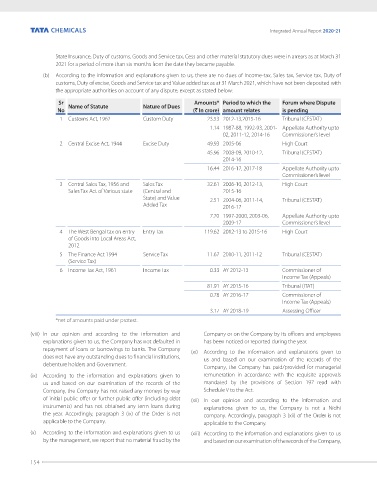

State Insurance, Duty of customs, Goods and Service tax, Cess and other material statutory dues were in arrears as at March 31

2021 for a period of more than six months from the date they became payable.

(b) According to the information and explanations given to us, there are no dues of Income-tax, Sales tax, Service tax, Duty of

customs, Duty of excise, Goods and Service tax and Value added tax as at 31 March 2021, which have not been deposited with

the appropriate authorities on account of any dispute, except as stated below:

Sr Amounts* Period to which the Forum where Dispute

No Name of Statute Nature of Dues (` In crore) amount relates is pending

1 Customs Act, 1962 Custom Duty 23.53 2012-13,2015-16 Tribunal (CESTAT)

1.14 1987-88, 1992-93, 2001- Appellate Authority upto

02, 2011-12, 2014-16 Commissioner’s level

2 Central Excise Act, 1944 Excise Duty 49.93 2005-06 High Court

45.96 2008-09, 2010-12, Tribunal (CESTAT)

2014-16

16.44 2016-17, 2017-18 Appellate Authority upto

Commissioner’s level

3 Central Sales Tax, 1956 and Sales Tax 32.61 2006-10, 2012-13, High Court

Sales Tax Act of Various state (Central and 2015-16

State) and Value 2.51 2004-06, 2011-14, Tribunal (CESTAT)

Added Tax 2016-17

7.70 1997-2000, 2003-06, Appellate Authority upto

2009-17 Commissioner’s level

4 The West Bengal tax on entry Entry Tax 119.62 2012-13 to 2015-16 High Court

of Goods into Local Areas Act,

2012

5 The Finance Act 1994 Service Tax 11.67 2010-11, 2011-12 Tribunal (CESTAT)

(Service Tax)

6 Income Tax Act, 1961 Income Tax 0.33 AY 2012-13 Commissioner of

Income Tax (Appeals)

81.91 AY 2015-16 Tribunal (ITAT)

0.78 AY 2016-17 Commissioner of

Income Tax (Appeals)

3.17 AY 2018-19 Assessing Officer

*net of amounts paid under protest.

(viii) In our opinion and according to the information and Company or on the Company by its officers and employees

explanations given to us, the Company has not defaulted in has been noticed or reported during the year.

repayment of loans or borrowings to banks. The Company (xi) According to the information and explanations given to

does not have any outstanding dues to financial institutions, us and based on our examination of the records of the

debenture holders and Government. Company, the Company has paid/provided for managerial

(ix) According to the information and explanations given to remuneration in accordance with the requisite approvals

us and based on our examination of the records of the mandated by the provisions of Section 197 read with

Company, the Company has not raised any moneys by way Schedule V to the Act.

of initial public offer or further public offer (including debt (xii) In our opinion and according to the information and

instruments) and has not obtained any term loans during explanations given to us, the Company is not a Nidhi

the year. Accordingly, paragraph 3 (ix) of the Order is not company. Accordingly, paragraph 3 (xii) of the Order is not

applicable to the Company. applicable to the Company.

(x) According to the information and explanations given to us (xiii) According to the information and explanations given to us

by the management, we report that no material fraud by the and based on our examination of the records of the Company,

154