Page 279 - Tata_Chemicals_yearly-reports-2019-20

P. 279

Integrated report Statutory reportS Financial StatementS

Consolidated

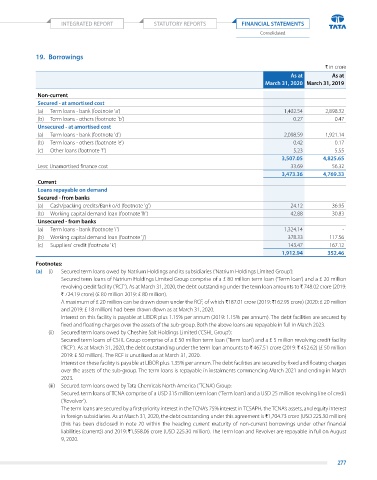

19. Borrowings

` in crore

As at As at

March 31, 2020 March 31, 2019

Non-current

Secured - at amortised cost

(a) term loans - bank (footnote 'a') 1,402.54 2,898.32

(b) term loans - others (footnote 'b') 0.27 0.47

Unsecured - at amortised cost

(a) term loans - bank (footnote 'd') 2,098.59 1,921.14

(b) term loans - others (footnote 'e') 0.42 0.17

(c) other loans (footnote 'f') 5.23 5.55

3,507.05 4,825.65

less: unamortised finance cost 33.69 56.32

3,473.36 4,769.33

Current

Loans repayable on demand

Secured - from banks

(a) Cash/packing credits/Bank o/d (footnote 'g') 24.12 36.95

(b) Working capital demand loan (footnote 'h') 42.88 30.83

Unsecured - from banks

(a) term loans - bank (footnote 'i') 1,324.14 -

(b) Working capital demand loan (footnote 'j') 378.33 117.56

(c) Suppliers' credit (footnote 'k') 143.47 167.12

1,912.94 352.46

Footnotes:

(a) (i) Secured term loans owed by natrium Holdings and its subsidiaries (‘natrium Holdings limited group’):

Secured term loans of natrium Holdings limited group comprise of a £ 80 million term loan (‘term loan’) and a £ 20 million

revolving credit facility (‘rCF’). as at March 31, 2020, the debt outstanding under the term loan amounts to ` 748.02 crore (2019:

` 724.19 crore) (£ 80 million 2019: £ 80 million).

a maximum of £ 20 million can be drawn down under the rCF, of which `187.01 crore (2019: `162.95 crore) (2020: £ 20 million

and 2019: £ 18 million) had been drawn down as at March 31, 2020.

Interest on this facility is payable at lIBor plus 1.15% per annum (2019: 1.15% per annum). the debt facilities are secured by

fixed and floating charges over the assets of the sub-group. Both the above loans are repayable in full in March 2023.

(ii) Secured term loans owed by Cheshire Salt Holdings limited (‘CSHl group’):

Secured term loans of CSHl group comprise of a £ 50 million term loan (‘term loan’) and a £ 5 million revolving credit facility

(‘rCF’). as at March 31, 2020, the debt outstanding under the term loan amounts to ` 467.51 crore (2019: ` 452.62) (£ 50 million

2019: £ 50 million). the rCF is unutilised as at March 31, 2020.

Interest on these facility is payable at lIBor plus 1.35% per annum. the debt facilities are secured by fixed and floating charges

over the assets of the sub-group. the term loans is repayable in instalments commencing March 2021 and ending in March

2023.

(iii) Secured term loans owed by tata Chemicals north america (‘tCna’) group:

Secured term loans of tCna comprise of a uSd 315 million term loan (‘term loan’) and a uSd 25 million revolving line of credit

(‘revolver’).

the term loans are secured by a first-priority interest in the tCna’s 75% interest in tCSapH, the tCna’s assets, and equity interest

in foreign subsidiaries. as at March 31, 2020, the debt outstanding under this agreement is `1,704.73 crore (uSd 225.30 million)

(this has been disclosed in note 20 within the heading current maturity of non-current borrowings under other financial

liabilities (current)) and 2019: `1,558.06 crore (uSd 225.30 million). the term loan and revolver are repayable in full on august

9, 2020.

277